Travel money card

New Worldwide Wallet travel cards are currently unavailable. We apologise for any inconvenience.

If you've picked up your Worldwide Wallet travel cards in branch, you have up until 25 October 2024 to activate your cards. If you’ve received your travel cards in the mail, you can continue to activate your cards past this date.

If you’ve activated your cards already, you can continue to use them as usual.

Important changes to Worldwide Wallet

From 1 May 2025, you can only load funds into your Worldwide Wallet from an eligible Westpac Group* transaction or savings account.

What this means for you

This means that you will no longer be able to load funds into your Worldwide Wallet from third-party financial institutions.

Please ensure you have an eligible Westpac Group* account to transfer funds into your Worldwide Wallet before 1 May 2025.

For more information on this change please read the Product Disclosure Statement (PDF 264KB).

*Eligible Westpac Group accounts include any eligible Westpac, St.George, Bank of Melbourne or BankSA branded transaction or savings account.

Explore our other options

Westpac Lite Credit Card has no foreign transaction fees, low purchase rate and low monthly fee. Credit criteria, T&Cs and fees apply.

International Money Transfer allows you to send foreign currency overseas with no Westpac fees*, via Online Banking or the Westpac App.

A smart and safe way to pay in foreign currencies

Features and benefits

- Travel and shop worry-free

Lock in your budget by converting your loaded AUD ahead of time and feel safe and secure from fraudulent transactions with Mastercard Zero Liability protection.¹

- Lounge access if your flight is delayed

You and a companion can get access to over 1,000 lounges² if your flight is delayed for 120 minutes or more. Visit the Mastercard Flight Delay Pass website to pre-register your flight. T&Cs apply.

- Access unforgettable experiences and rewards

Your Mastercard gives you access to Priceless® Cities with unforgettable experiences in the cities where you live and travel.³ You can also get cashback when you shop overseas with your Worldwide Wallet, thanks to Mastercard Travel Rewards.⁴

How it works

Save on fees

- Avoid ATM withdrawal fees

Through our Global ATM Alliance and overseas partner ATMs which you can easily find using the ATM locator in the Westpac App

- No foreign transaction fees

Avoid a 3% foreign transaction fee whenever you use your Worldwide Wallet to shop online or in person.

- No load or unload fees

Reload your account on the go, whenever you need.

- No account keeping fees

You won’t pay any inactivity or account keeping fees, so any funds left in your account will be there ready for your next trip or purchase.

Other fees may apply. Read the Product Disclosure Statement (PDF 264KB) for full list of fees.

Like to shop online?

Use your Worldwide Wallet for online purchases in foreign currencies and avoid a 3% foreign transaction fee.

You can also shop worry-free from fraudulent transactions with Mastercard Zero Liability protection.1

Complete visibility and control

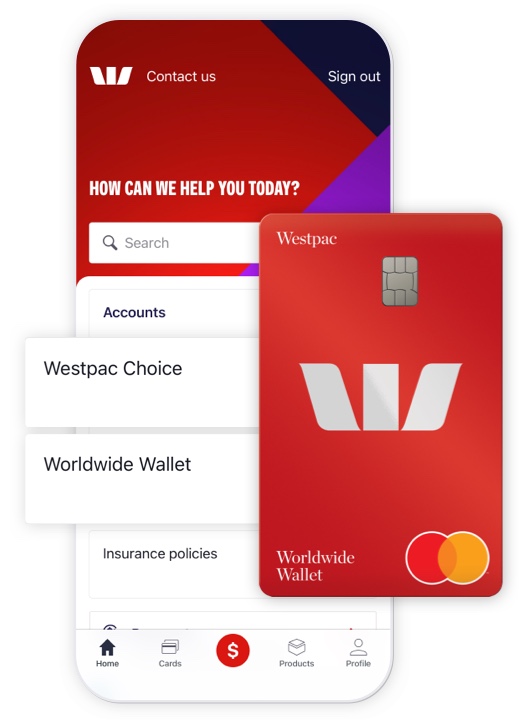

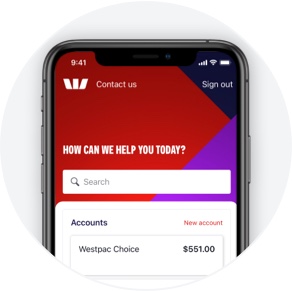

All in one view

See your account balance and transactions in the Westpac App or in Online Banking.

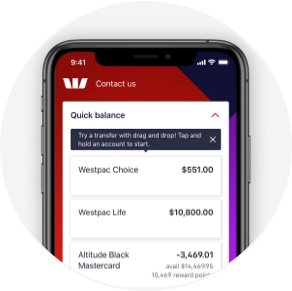

Move money easily

Transfer money to and from your Worldwide Wallet and convert AUD into foreign currencies while you’re on the go in the Westpac App.

More ways to pay

Add your Worldwide Wallet to Google Pay™ or use your card to tap and go.

A spare card for peace of mind

Both cards give you access to the same funds and can be locked and unlocked instantly at your convenience via Online Banking or the Westpac App.6

Add up to 11 currencies

Lock in your rate head of time by converting currency in advance.

You'll still be able to spend in currencies not listed here and avoid Westpac's 3% foreign transaction fee.

To view our latest rates, see our currency converter.

| Available currencies | |||

|---|---|---|---|

|

AUD - Australian Dollar |  |

USD - United States Dollar |

|

EUR - Euro |  |

GBP - British Pound |

|

NZD - New Zealand Dollar |  |

CAD - Canadian Dollar |

|

JPY - Japanese Yen |  |

THB - Thai Baht |

|

ZAR - South African Rand |  |

SGD - Singapore Dollar |

|

HKD - Hong Kong Dollar | ||

FAQs

With the Westpac Worldwide Wallet, you can avoid a 3% foreign transaction fee when you shop online in available currencies.

You can shop safely by loading only what you need into any of the following currencies: USD, EUR, GBP, CAD, JPY, THB, ZAR, SGD, NZD and HKD. By knowing exactly how much of a foreign currency is loaded on your card, you can stay on top of your spending.

You’ll also benefit from Mastercard Zero Liability protection,1 so you can shop worry-free from fraudulent transactions.

Things you should know

Westpac Retail and Business Banking Financial Services Guide and Credit Guide (PDF 249KB)

*Westpac transfer fees still apply for funds sent in Australian dollars. Other bank fees may also apply, check the currency converter for indicative rates and fees. To send and receive an international money transfer you must hold an eligible Westpac transaction account. Fees and charges may apply on a Westpac transaction account.