The day we turned internet banking on – 25 years ago

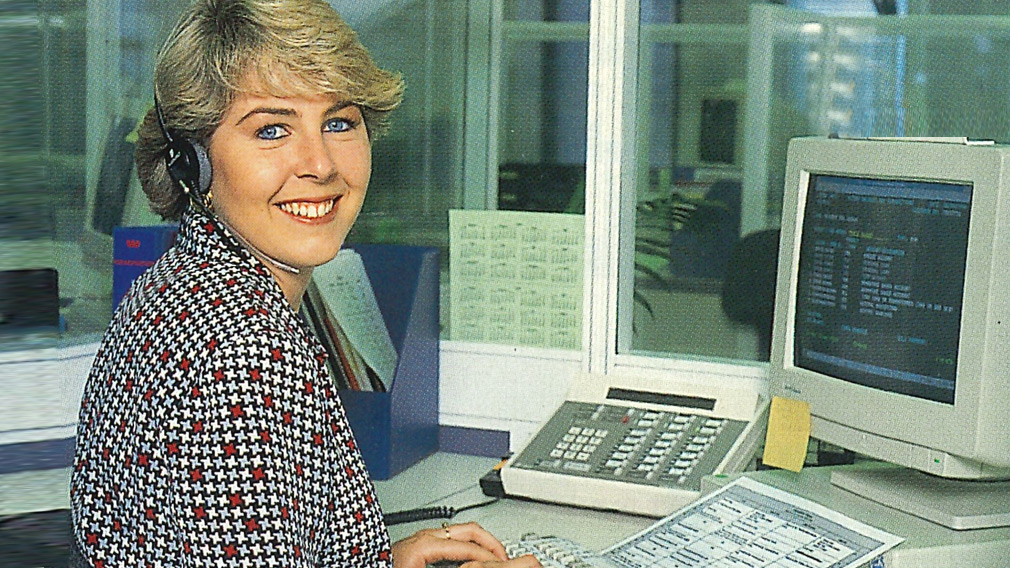

An employee at her computer around the time internet banking was first switched on 25 years ago. (Westpac Archives)

Nobody believed we could do it.

In fact, hardly anyone even wanted us to.

But this week, 25 years ago, we switched on the first internet banking system in Australia, our bank customers becoming some of the very first in the world to experience it.

For today’s younger generations (who won’t recall that unmistakable 90s technoaudio soundtrack of dial-up modems), it’s almost impossible to comprehend how banking was even done before the internet.

The stepping-stone to this miracle was a floppy disk (“What on earth is a floppy disk?” I hear the young’uns ask) mailed to your home with software you installed onto your PC, which could “talk” via modems through the phone lines with the bank’s systems. Checking your bank account balance and making a transfer was about the extent of the functionality, usually at a hefty price.

By 1994, Australian Bureau of Statistics data shows that while almost 30 per cent of Australian households had bought a computer, very few had access to the “world wide web”, as it was then known.

Indeed, it had only been five years since Australia made its first connection to the global internet in June 1989 by university computer scientists – a link that provided less than 60 kilobits of connectivity: not even enough to stream one song!

An personal computer, circa 1986. (Getty)

As very few people had begun to even grasp the point of the internet and just a handful of companies had started to build their first basic websites, bank customers were certainly not demanding internet banking. At that point, telephone banking and ATMs was still relatively amazing new tech.

So when in early 1995, John Thame, then CEO of Advance Bank – acquired two years later by St.George Bank, which subsequently became part of Westpac Group – called in his team of senior managers and technologists (a few of us are still with Westpac to this day) and outlined his vision of introducing internet banking for customers, I don’t think anyone in the room thought it was feasible. But we knew he was serious.

After his team told him all the reasons it wouldn’t work – the technology didn’t exist, it wouldn’t be secure, the bank didn’t even have a website yet, customers don’t want it and couldn’t use it anyway because they didn’t have internet access – his response was pretty simple: “If you guys can’t do it, I will find others who can.”

So, we got cracking and just ten months later, on 5 December 1995, we launched internet banking in Australia. It would be another two to three years until other major banks would follow suit.

While it was infantile compared to what we have today, it truly was revolutionary.

I remember the design of the website clearly: very simple and text-based, with all the graphics paired back so it was fast enough for people to use given high-speed internet didn’t yet exist. The first version allowed customers to view their account details and transaction history, and we soon added transfers, third-party payments and open term deposit accounts functions.

I also remember being gobsmacked that within the first month, around 350 customers had used it almost 600 times.

Fast forward 25 years, around 86 per cent of Australian households have internet at home and there are around 27 million mobile handset subscribers in Australia – enabling you to put banking literally in your pocket.

Among Westpac Group retail customers, more than 5 million bank digitally. In the last financial year, customers logged into their banking 1.8 billion times, made almost 550m digital transactions, and more than 40 per cent of products were bought digitally. In excess of 60 per cent of customers get their bank account statements electronically and 42 per cent of St.George mortgages were taken out digitally.

Mobile banking surfaced in 2008 and now 80 percent of our consumer customer interactions are through mobile!

Dhiren Kulkarni (left) with John Thame, former CEO of Advance Bank and the visionary behind internet banking. (Supplied)

With technological innovation possibilities almost endless now that bandwidth and storage constraints are gone and potential integration with so many new technologies and solutions are a reality, the pace of new banking feature releases has never been so fast.

Digital innovation has redefined the competitive banking landscape, and accelerated as the COVID-19 pandemic has seen even more customers make the shift from to physical bank outlets to online services.

Given this, it is just as hard to predict what banking’s technology future holds as it was 25 years ago.

But one thing is for sure: it will be far different to what it does today.

The companies that will succeed will be those with visionary leaders, who can see what customers will want before they know it themselves, who believe change is possible, remain nimble enough to turn vision into reality, and successfully execute with speed regardless of company size.

Just like John Thame a quarter of a century ago.