Virescent fund aims to empower climate tech innovators

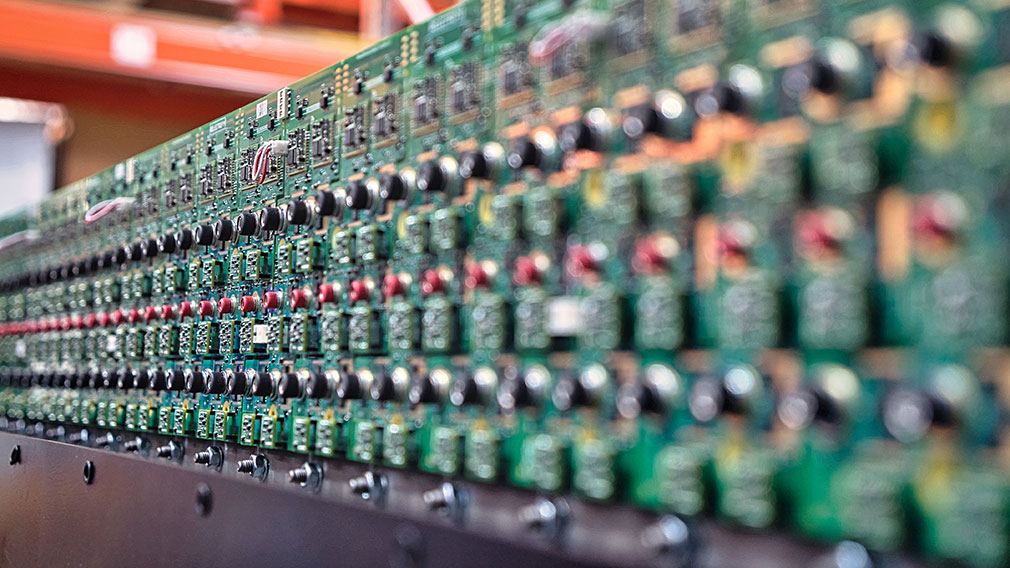

Relectrify's battery cell technology. (Supplied)

Australia’s clean energy transition will require the mobilisation of public and private capital on a giant scale, not just to build out renewable power capacity but also support innovative startups who are tackling some of the biggest challenges faced by the sector.

That’s why climate tech-focused funds like Virescent Ventures play such a key role as enablers.

Virescent has just completed a $100 million first close of its second climate technology investment fund, supported by cornerstone investors Westpac and the government’s Clean Energy Finance Corporation (CEFC).

The fund will look to build on the success of Virescent’s first portfolio, managed on behalf of the CEFC, which has seen more than $270 million deployed across 34 Australian climate tech investments.

Among the companies to have benefited from Virescent’s initial fund is Melbourne-based Relectrify, which is developing technology to improve the efficiency and longevity of battery energy storage systems.

“We’re trying to address one of the biggest weaknesses of the current battery energy storage system architecture,” says Relectrify CEO Jeff Renaud.

“Today’s systems are built with many battery cells connected in series with each other. That means the performance of the battery system is limited by its weakest cell - if one cell goes bad the entire system’s performance is degraded.

“We have built a new architecture that can individually manage each battery cell in these systems so instead of being limited by the weakest cell, we can treat every battery cell differently.”

The company’s CellSwitch® technology can extend a battery system’s lifetime by up to 30 per cent, according to Relectrify.

“We also have better data and control over what’s happening in the system so that we can provide enhanced safety and other advanced control features,” Renaud says.

For example, Relectrify’s technology removes the need for an inverter – an essential component of most current battery systems - which converts DC power to the AC power needed for homes and businesses.

“We do away with the inverter and generate AC power directly from the battery cells through the orchestration provided by our control technology.”

Relectrify has been working with a leading battery cell manufacturer on a product which incorporates its technology and plans to start rolling it out to commercial and industrial customers early in the new year.

Relectrify CEO Jeff Renaud. (Supplied)

Virescent was one of the earliest investors in Relectrify, supporting them through multiple funding rounds, and Renaud says their support has been integral in helping to grow the business.

“The perspective that Virescent has on the energy market, both because of the people that they’ve brought into the fund and also their connections to the CEFC and the broader energy ecosystem, is extremely valuable for us as we try and chart the right course for the business.”

Westpac’s support for the new Virescent fund aligns with the bank’s aim to identify and support Australia’s clean tech innovators, says Peter Herbert, Chief Operating Officer, Business & Wealth, at Westpac.

“This strategic relationship will enable us to partner with leading specialists in fast moving and highly specialised sectors. Through this investment we’ll have the opportunity to identify emerging climate leaders and potentially work with them to provide leading solutions for our customers.”

Virescent has been an early backer of some of the biggest success stories in Australia’s clean energy tech sector. They include Hysata, which is commercialising a high-efficiency hydrogen electrolyser, and JET Charge, Australia’s largest EV charging infrastructure company.

Asked what advice he would give to other clean tech startups, Renaud acknowledges it can be challenging for a disruptor to compete with big companies with deep pockets for R&D investment. Having the support of an early investor like Virescent is important.

“It’s also about figuring out where you can apply your technology first - finding that first customer who has a need that you can uniquely meet.”

And while Relectrify’s long-term plans include selling its product in overseas markets, Renaud has no doubt his company is in the right place.

“For a company that’s in the energy tech space, Australia is at the leading edge of global markets for the renewable energy transition and dealing with the challenges that come with that. It’s a great place to have a novel solution and bring it to market.”