LUCI’S CALL: Cost-of-living dominates pre-election budget

Cost-of-living was the big theme in Treasurer Jim Chalmers’ budget – his last before a federal election due in May.

We already knew that the electricity rebates introduced last year were going to be extended by six months, but the big surprise was the announcement of additional tax cuts.

The bottom tax bracket will be lowered from 16 per cent to 15 per cent in 2026 and to 14 per cent in 2027. While it’s a modest adjustment, it will still make a bit of a difference to many lower income households.

Other measures designed to help ease cost-of-living pressures included cheaper medicines, incentives for more bulk billing for medical appointments, and support for the hospitality industry by capping the increase in excise on draft beer.

The overall state of the budget is broadly in line with our expectations.

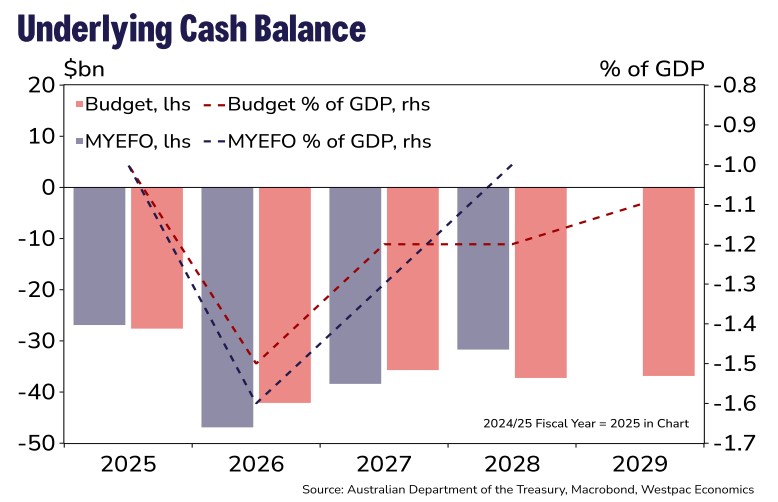

Treasury is forecasting an underlying deficit of $27.6 billion in 2024/25, or around 1 per cent of GDP. While this marks a notable turnaround from the $15.8 billion surplus recorded in 2023/24, it’s only a $0.7 billion deterioration compared with projections given in the mid-year budget update in December.

The deficit is expected to widen to 1.5 per cent of GDP in 2025/26. We see slightly smaller deficits beyond that, at around 1 per cent of GDP.

Chalmers has been able to fund the cost-of-living measures thanks to Treasury upgrading its assessment of the economy. The forecast for unemployment has been revised down which, all things being equal, should lead to higher income tax revenues and a smaller bill for unemployment benefits.

There are also a lot of initiatives that won’t cost any money to the budget bottom line. They include regulatory changes to make things easier for small businesses, extended protections against unfair trading, and non-compete clause bans for lower- and middle-income workers.

Final budget outcomes often differ from what is announced on budget night. This time around, those outcomes will be particularly dependent on how the labour market plays out: whether unemployment does stay as low as Treasury is forecasting and therefore tax receipts are as high as they expect.

While there were a few surprises, especially in the out-years, by and large this is a budget designed to focus on the core issues of cost-of-living and the domestic economy.

There are plenty of risks overseas, but Treasury modelling suggests that Australia will be relatively well insulated from them.

For more analysis from Luci and the rest of the Westpac Economics team, visit WestpacIQ.