WELCOME TO WESTPAC CHOICE FOR KIDS AND TEENS

Now that you've got your Westpac Choice account, let's help you get set up, so you'll be ready to use your money the way you want.

Let’s get you up and running

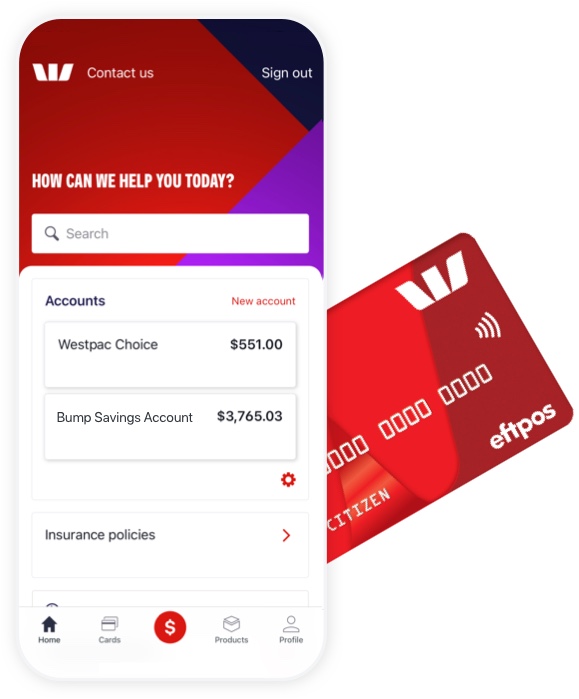

Bank on your phone

Download the Westpac App so you can bank anytime, anywhere.*

Make your first deposit

Deposit or transfer money into your account if you haven’t already.

Use your Digital Card

Don’t wait for your card to arrive. Use the digital one in the Westpac App.

Pocket money and chores

Grow your independence with regular pocket money paid into your account.

Manage your money with a Debit Card

If you’re at least 8 years old, you can link a Debit Mastercard®2 to your Westpac Choice Youth account, giving a kick-start to your money skills with kid-friendly features that will help keep your money safe and secure.

The debit card is automatically linked when the account is opened, except for children under 14. For children 8-13, a parent or guardian must order their card separately.

Financial Literacy for Kids & Teens

We're here to help teach kids and teens how to better manage their money.

How do I order and activate a Debit Card online?

Upon opening a Westpac Choice Youth account, holders aged 14 and over will automatically receive a Debit Mastercard. Debit cards must be ordered separately for younger account holders aged 8 to 13.

1. Register for Online Banking

Both parents/guardians and the child (as the account holder) will need to be registered for Online Banking. Register now

2. Download the Westpac App

Parents/guardians should download the Westpac App to order the card on the child's behalf and access their child's card controls. Get the Westpac App

3. Order a new Debit Card

Parents/guardians with third party access to a child's account can order the debit card by signing into the Westpac App, using their Online Banking, not the child's:

- Search for and then tap Family Hub

- Find the child's Westpac Choice Youth account

- Order Debit Mastercard.

4. Activate Debit Card

Upon receipt of the card, the child must sign in to Online Banking using their Customer ID and password to activate it. If you'd prefer your child not use Online Banking, the card can be activated at any branch.

What else can I do?

Get access to your account on your phone with the Westpac App or on your laptop with Online Banking to:

Lock your card if you’ve lost it

Lost or had your actual card stolen? Lock your card in the Westpac App until you find it or can report it stolen.

Quick payments with PayID®

Near-instant payments into your account from any other Aussie bank using just your mobile number.

Keep an eye on your money

Get notifications every time money goes in or out of your account. Parents can be added to receive them, too.1

Use your card security features

The CVC (3 numbers on the back of your card) changes every 24 hours on your digital card for extra security.

Under 18? You could get $50 on us

Open both a Choice Youth everyday account and a Bump savings account. Deposit at least $100 into your savings within 30 days, and we’ll give you $50. Ends 31/01/2026. New customers only. T&Cs apply.

Don’t break the piggy bank

Set up a savings goal

Buddy up your Westpac Choice account with a Westpac Bump savings account to:

- Keep your spending and savings separate

- Set up savings goals, like a fun, wish list, or wealth building goal

- Share savings goals with family and friends to help reach your goals sooner

- Get in the habit of putting money away, so you won't break the piggy bank when you want to cash in.

Help for parents

Good money habits start at home. We give you the know-how to help you help your kids:

Things you should know

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

The Westpac App is only available for use by Westpac Australia customers.

*Internet connection is needed to access the Westpac App. Normal mobile data charges apply.

1. Third Party Push Notifications: A third party, such as parent or guardian, who has been granted access to a Westpac Bump Savings or Choice Youth account can choose to receive real-time mobile push notifications for when account transactions occur.

3. Parental Control: Parent or legal guardian must be an account signatory to have Parental Control. There’s a limit of two signatories per Bump Savings account. Parental Control does not apply to a child’s access to funds in branch, however a parent (or guardian) signatory must authorise branch withdrawals where a child is under 12. Child if eligible must be registered for Westpac Online Banking and Westpac Telephone Banking to access accounts online or over the phone. Bump Savings account holders have access to their account via Online Banking and Telephone Banking, subject to any Parental Controls. For children aged 12 years and over: Parental Control is optional and access levels can be amended by the child at any time. For children under the age of 12: Parental Control is mandatory, and self service Telephone Banking is not available.

Mastercard® is a registered trademark and the circles design is a trademark of Mastercard International Incorporated.

Apple, the Apple logo and iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Android, Google Play and the Google Play logo are trademarks of Google LLC.