- Business

- EFTPOS & eCommerce

- Merchant Support Centre

- Merchant statements

Understanding your Merchant Statement

Welcome to your merchant statement guide

Thanks for choosing us as your merchant services provider1. This guide will help you understand your merchant statement.

For every month you have a Westpac merchant facility, a statement is generated to show:

- Your merchant details

- Transactions processed and billed for the month^

- Fees paid for processing transactions and billed for the month

^Note: American Express®, Diners and JCB transactions are not included in merchant statements and are invoiced separately. UnionPay3 is only included for EFTPOS Connect, PayWay, Quickstream and Quest QT720 products.

Select your merchant statement

Select the plan or statement type that’s based on your Fee Schedule for an overview of your merchant statement.

Customised Pricing

Customised Pricing is where your business has chosen customised pricing based on the monthly card transactions2 volume/value and transaction type processed through your merchant facility.

Part 1 of 3: Summary

The account and transaction information in this example are for illustrative purposes only and do not represent actual data.

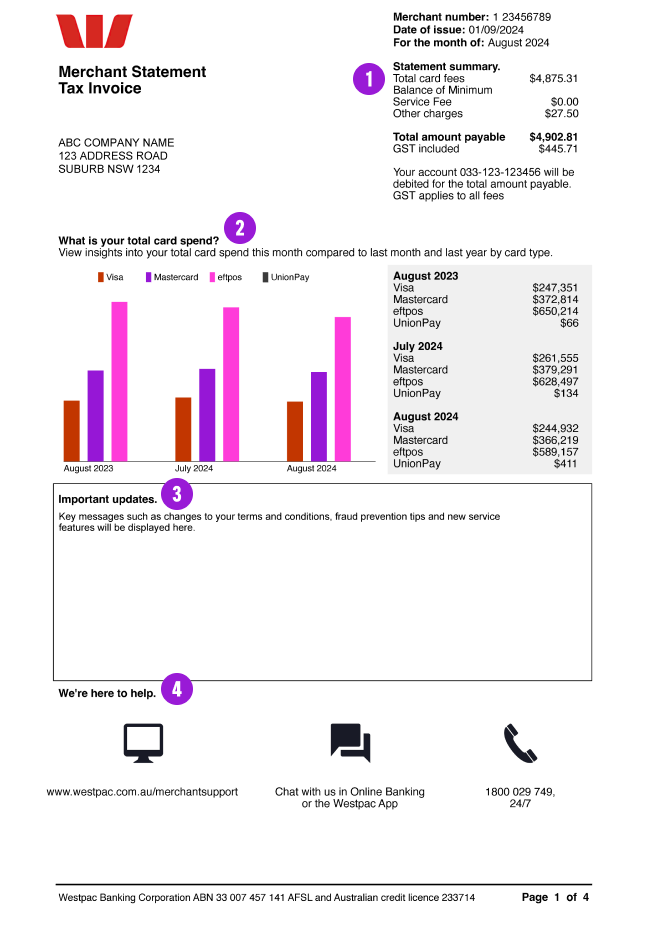

Statement summary

- Total card fees: fees payable for debit and credit transactions for the month. This includes Merchant Service Fees (MSF), Scheme Fees and Interchange Fees where applicable.

- Balance of Minimum Service Fee: if the Merchant Service Fees falls below the Minimum Merchant Service Fee, you will be charged the balance.

- Other charges: any other fees charged for the month.

- Total amount payable: total value of your total card fees, balance of Minimum Service Fee and other charges. This amount is inclusive of GST.

- GST included: GST is derived by dividing the total amount payable by 11.

Total card spend

This section displays the total amount of purchase and refund transactions you’ve processed by card type (Visa, Mastercard®, eftpos and UnionPay3).

Important updates

This section displays key messages to help you effectively manage your merchant facilities. These messages will vary each month based on what you need to know or what’s changing including when we update our terms and conditions.

We’re here to help

This section displays where you can go to ask questions or find out more about your merchant facilities.

Part 2 of 3: Transactions

The account and transaction information in this example are for illustrative purposes only and do not represent actual data.

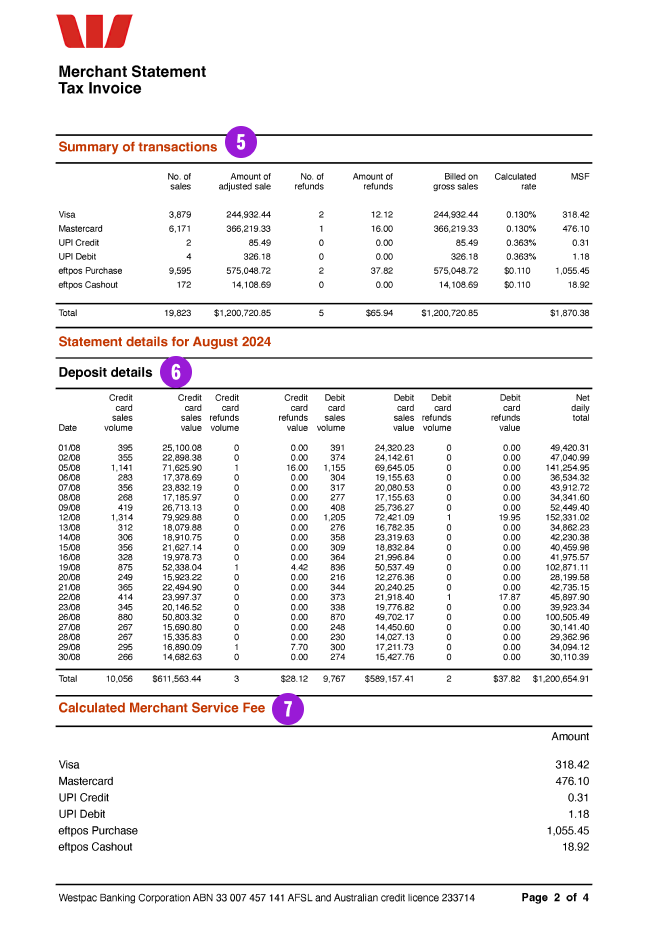

Summary of transactions

This section displays the following for each card type. Fees include GST unless stated otherwise.

- Number of sales: total number of credit and debit sale transactions2 for the month.

- Amount of adjusted sales: accumulated total of daily deposits including any deposits that may have been adjusted.

- Number of refunds: total number of credit and debit refund transactions2 for the month.

- Amount of refunds: total value of the refunds for the month.

- Billed on gross sales: total gross value that will be charged the applicable Merchant Service Fee. For net-billed merchants, this will show as net and be billed on net sales.

- Calculated rate: Merchant Service Fee for credit and debit transactions2, expressed as a percentage (%) or as a per transaction dollar ($) rate. This column will not be totalled.

- MSF: your Merchant Service Fee expressed as a dollar value.

Statement details

This section includes the list of your total daily deposits for the statement cycle broken down by credit transactions (Visa, Mastercard and UnionPay3) and debit transactions (eftpos Purchase and eftpos Cash Out)2.

Calculated Merchant Service Fee

This section displays the fee Westpac Group charge you for processing credit transactions (Visa, Mastercard and UnionPay3) and debit transactions (eftpos Purchase and eftpos Cash Out)2.

Part 3 of 3: Fees and charges

The account and transaction information in this example are for illustrative purposes only and do not represent actual data.

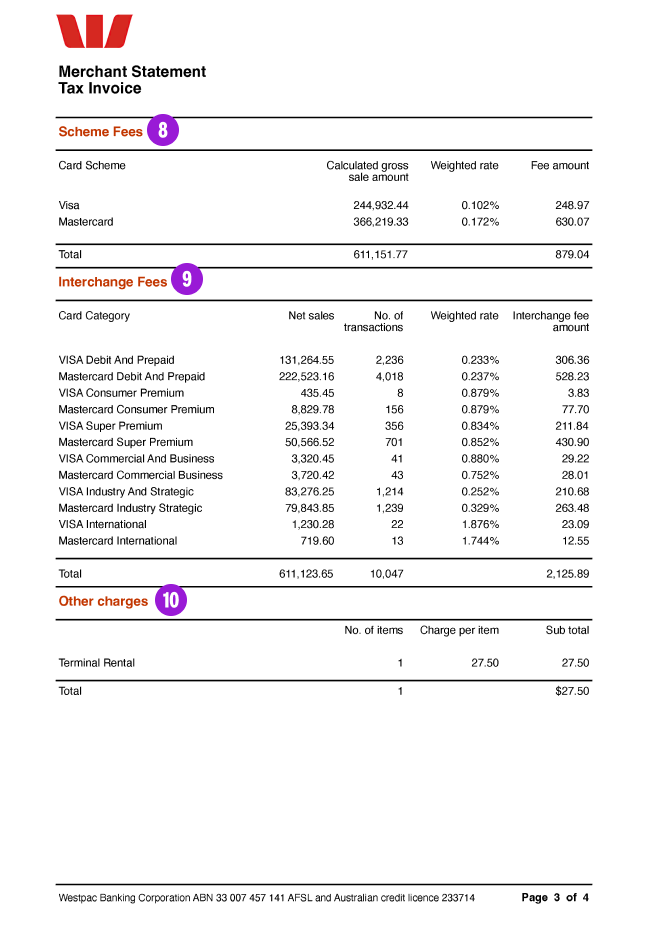

Scheme Fees

This section displays Scheme Fees that are charged by Westpac to cover the costs associated with processing Visa, Mastercard and UnionPay3 transactions. These fees will vary depending on factors, such as the card scheme (e.g. Visa, Mastercard or UnionPay3), where the card was issued (e.g. Australia or overseas).

This will only display if you are on customised pricing – Direct. If you do not know your fee structure, call us on 1800 029 749. We’re available 24/7.

Interchange Fees

This section groups the fees set by card schemes as a weighted average and applied on credit transactions calculated as a % or as a per transaction charge depending on the type of card being processed.

These card categories will only display when you have processed a transaction from that card category for the month.

This will only display if you are on customised pricing – Interchange Plus or Direct. If you do not know your fee structure, call us on 1800 029 749. We’re available 24/7.

Groups* may include:

- Visa Debit and Prepaid

- Mastercard Debit and Prepaid

- Visa Consumer Standard

- Mastercard Consumer Standard

- Visa Consumer Premium

- Mastercard Consumer Premium

- Visa Super Premium

- Mastercard Super Premium

- Visa Commercial and Business

- Mastercard Commercial and Business

- Visa Industry and Strategic

- Mastercard Industry Strategic

- Visa International

- Mastercard International

- UnionPay3

*Groups are regularly updated to reflect any changes made by Visa, Mastercard and UnionPay3.

Other charges

This section displays any other fees charged for the month.

These could include the fees listed below (and any other applicable fees):

- Monthly Terminal Fee (also known as Terminal Rental)

- Chargeback Fee.

The account and transaction information in this example are for illustrative purposes only and do not represent actual data.

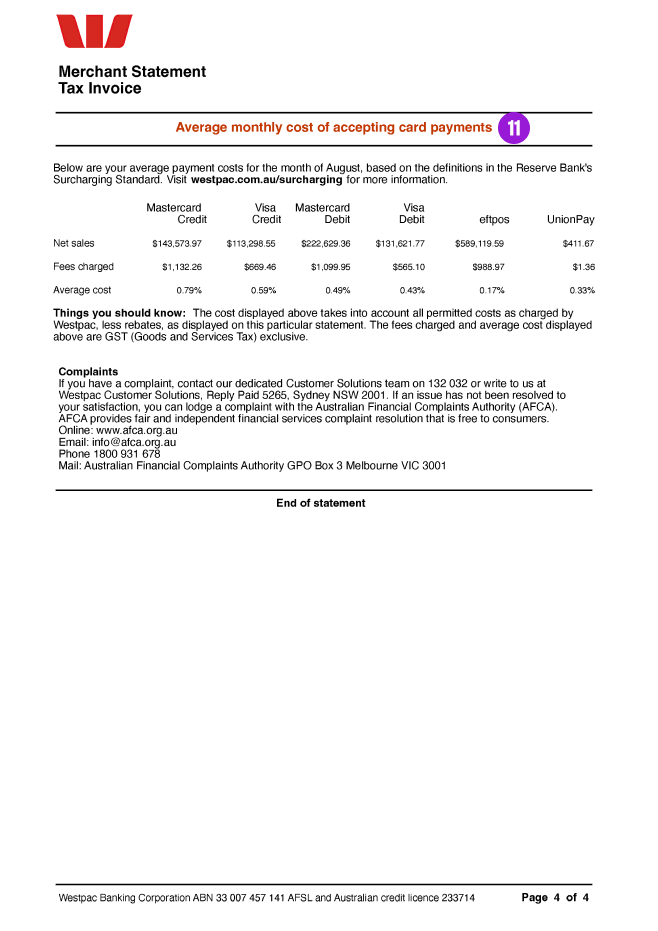

Average monthly cost of accepting card payments

Your June monthly statement, issued in early July each year, will include two tables which show how much you are being charged to process payments for the different card types. One table will show you your monthly cost of accepting card payments and the other table will show your average annual cost of accepting card payments (by card type).

The amount shown is the maximum percentage surcharge you will be able to apply to a customer’s transaction if they pay by card. If a payment surcharge is applied, you will need to provide adequate disclosure to the customer and be clear about the nature of the fee and the circumstances in which it applies before processing the transaction.

For an example of how this table will display on your merchant statement, go to cost of accepting card payments.

Merchant Pricing Plan

A Merchant Pricing Plan2 is where your business has chosen a fixed monthly fee based on the monthly card transactions2 volume/value processed through your merchant facility.

Part 1 of 3: Summary

The account and transaction information in this example are for illustrative purposes only and do not represent actual data.

Statement summary

- Plan charges: monthly fee as per your Fee Schedule.

- Excess charges: fees charged on the value of transactions which exceed the Included Value4.

- Other charges: any other fees charged for the month.

- Total amount payable: total value of your plan charges, excess charges and other charges. This amount is inclusive of GST.

- GST included: GST is derived by dividing the total amount payable by 11.

Total card spend

This section displays the total amount of purchase and refund transactions you’ve processed by card type (Visa, Mastercard®, eftpos and UnionPay3).

Important updates

This section displays key messages to help you effectively manage your merchant facilities. These messages will vary each month based on what you need to know or what's changing including when we update our terms and conditions.

We’re here to help

This section displays where you can go to ask questions or find out more about your merchant facilities.

Part 2 of 3: Transactions

The account and transaction information in this example are for illustrative purposes only and do not represent actual data.

Summary of transactions

This section displays the following for each card type. Fees include GST unless stated otherwise.

- Included Value4: total maximum dollar value of Visa, Mastercard and eftpos transactions processed through your merchant facility per month included in your Plan Fee.

- Number of sales: total number of credit and debit sale transactions2 for the month.

- Amount of adjusted sales: accumulated total of daily deposits including any deposits that may have been adjusted.

- Number of refunds: total number of credit and debit refund transactions2 for the month.

- Amount of refunds: total value of the refunds for the month.

- Billed on gross sales: total gross value that will be charged the applicable Merchant Service Fee. For net-billed merchants, this will show as net and be billed on net sales.

- Excess fee rate: fee applied to the value of transactions above the Included Value4.

- Excess fee amount: amount charged on transactions after the Included Value4 has exceeded.

Statement details

This section includes the list of your total daily deposits for the statement cycle. The list is broken down by credit transactions (Visa, Mastercard and UnionPay3) and debit transactions (eftpos Purchase and eftpos Cash Out )2.

Plan charges

This section displays the monthly Plan Fee as per your Fee Schedule.

Excess charges

This section displays the charges applied to the transaction value which exceeds the Included Value4.

Part 3 of 3: Fees and charges

The account and transaction information in this example are for illustrative purposes only and do not represent actual data.

Other charges

This section displays any other fees charged for the month.

These could include the fees listed below (and any other applicable fees):

- Monthly Participation Fee

- Chargeback Fee.

Average monthly cost of accepting card payments

Your June monthly statement, issued in early July each year, will include two tables which show how much you are being charged to process payments for the different card types. One table will show you your monthly cost of accepting card payments and the other table will show your average annual cost of accepting card payments by card type.

The amount shown is the maximum percentage surcharge you will be able to apply to a customer’s transaction if they pay by card. If a payment surcharge is applied, you will need to provide adequate disclosure to the customer and be clear about the nature of the fee and the circumstances in which it applies before processing the transaction.

For an example of how this table will display on your merchant statement, go to cost of accepting card payments.

Chain or Headquarter Statement

In certain situations where more than one merchant facility is owned by your business, a separate Chain or Headquarter statement outlining the monthly card transactions2 processed for all merchant facilities may be available.

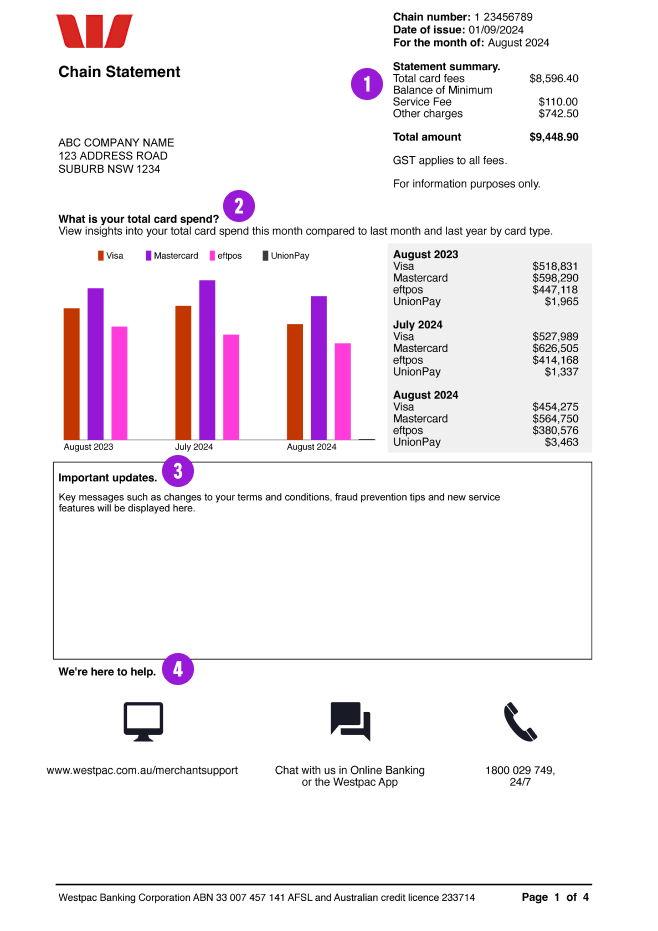

Part 1 of 3: Summary

The account and transaction information in this example are for illustrative purposes only and do not represent actual data.

Statement summary

- Total card fees: fees payable for debit and credit transactions for the month. This includes Merchant Service Fees, Scheme Fees and Interchange Fees where applicable.

- Balance of Minimum Service Fee: if the Merchant Service Fees falls below the Minimum Merchant Service Fee, you will be charged the balance.

- Other charges: any other fees charged for the month.

- Total amount payable: total value of your total card fees, balance of Minimum Service Fee and other charges.

Total card spend

This section displays the total amount of purchase and refund transactions you’ve processed by card type (Visa, Mastercard®, eftpos and UnionPay3).

Important updates

This section displays key messages to help you effectively manage your merchant facilities. These messages will vary each month based on what you need to know or what's changing including when we update our terms and conditions.

We’re here to help

This section displays where you can go to ask questions or find out more about your merchant facilities.

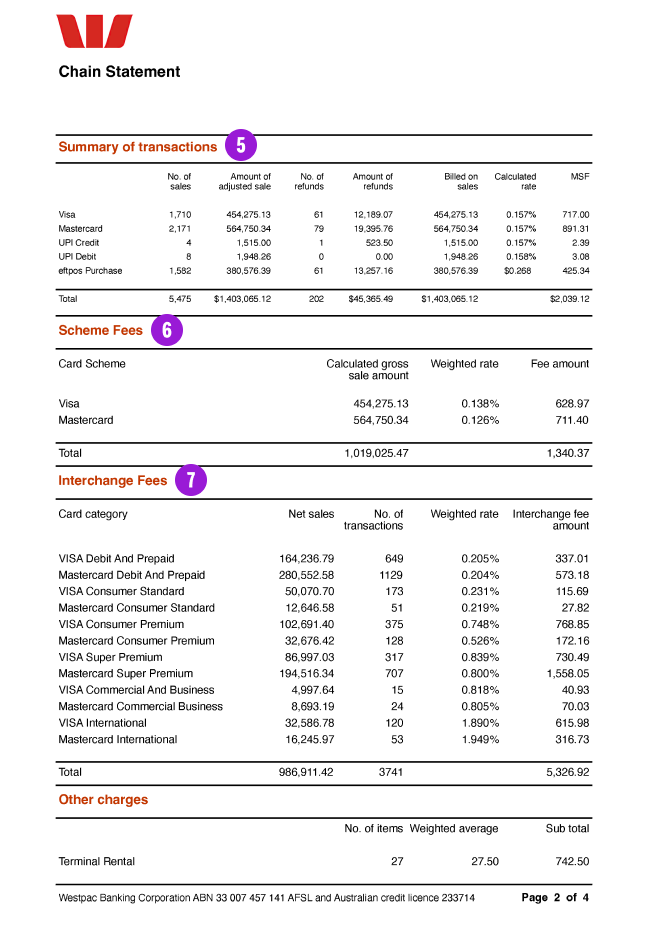

Part 2 of 3: Transactions

The account and transaction information in this example are for illustrative purposes only and do not represent actual data.

Summary of transactions

This section displays the following for each card type. Fees include GST unless stated otherwise.

- Number of sales: total number of credit and debit sale transactions2 for the month.

- Amount of adjusted sales: accumulated total of daily deposits including any deposits that may have been adjusted.

- Number of refunds: total number of credit and debit refund transactions2 for the month.

- Amount of refunds: total value of the refunds for the month.

- Billed on sales: total value that will be charged the applicable Merchant Service Fee.

- Calculated rate: Merchant Service Fee for credit and debit transactions2, expressed as a percentage (%) or as a per transaction dollar ($) rate. This column will not be totalled.

- MSF: your Merchant Service Fee expressed as a dollar value.

Scheme Fees

This section displays Scheme Fees that are charged by Westpac to cover the costs associated with processing Visa, Mastercard and UnionPay3 transactions. These fees will vary depending on factors, such as the card scheme (e.g. Visa, Mastercard or UnionPay3), where the card was issued (e.g. Australia or overseas).

This will only display if you are on customised pricing – Direct. If you do not know your fee structure, call us on 1800 029 749. We’re available 24/7.

Interchange Fees

This section groups the fees set by card schemes as a weighted average and applied on credit transactions calculated as a % or as a per transaction charge depending on the type of card being processed.

These card categories will only display when you have processed a transaction from that card category for the month.

This will only display if you are on customised pricing – Interchange Plus or Direct. If you do not know your fee structure, call us on 1800 029 749. We’re available 24/7.

Groups* may include:

- Visa Debit and Prepaid

- Mastercard Debit and Prepaid

- Visa Consumer Standard

- Mastercard Consumer Standard

- Visa Consumer Premium

- Mastercard Consumer Premium

- Visa Super Premium

- Mastercard Super Premium

- Visa Commercial and Business

- Mastercard Commercial Business

- Visa Industry and Strategic

- Mastercard Industry Strategic

- Visa International

- Mastercard International

- UnionPay3

*Groups are regularly updated to reflect any changes made by Visa, Mastercard and UnionPay3.

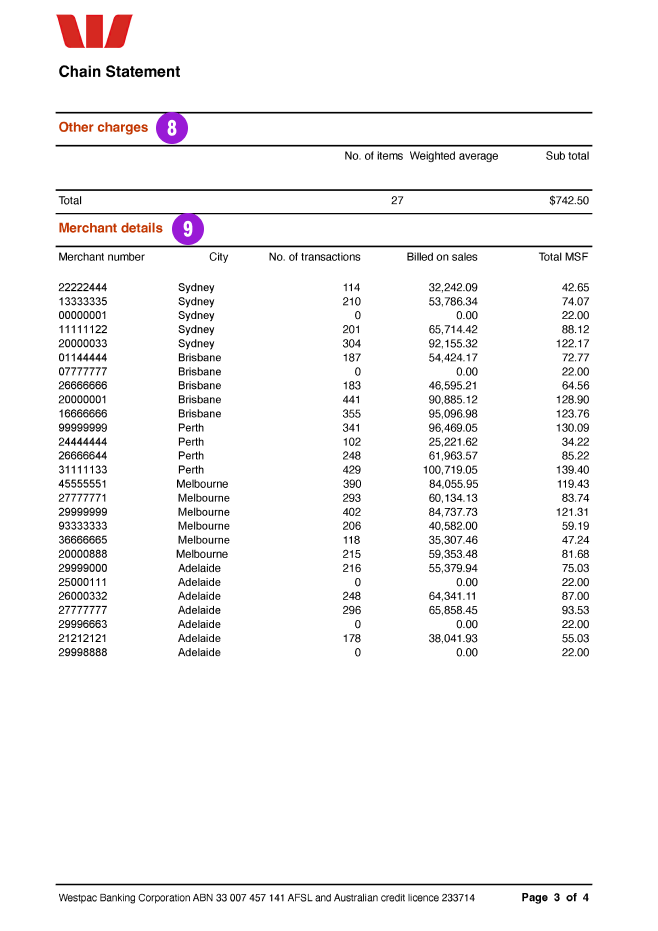

Part 3 of 3: Fees and charges

The account and transaction information in this example are for illustrative purposes only and do not represent actual data.

The account and transaction information in this example are for illustrative purposes only and do not represent actual data.

Other charges

This section displays any other fees charged for the month.

These could include the fees listed below (and any other applicable fees):

- Monthly Terminal Fee (also known as Terminal Rental)

- Chargeback Fee.

Merchant details

This section displays the city, number of transactions2, total value that will be charged the applicable Merchant Service Fee and total Merchant Service Fee expressed as a dollar value per merchant ID under the Chain or Headquarter merchant.

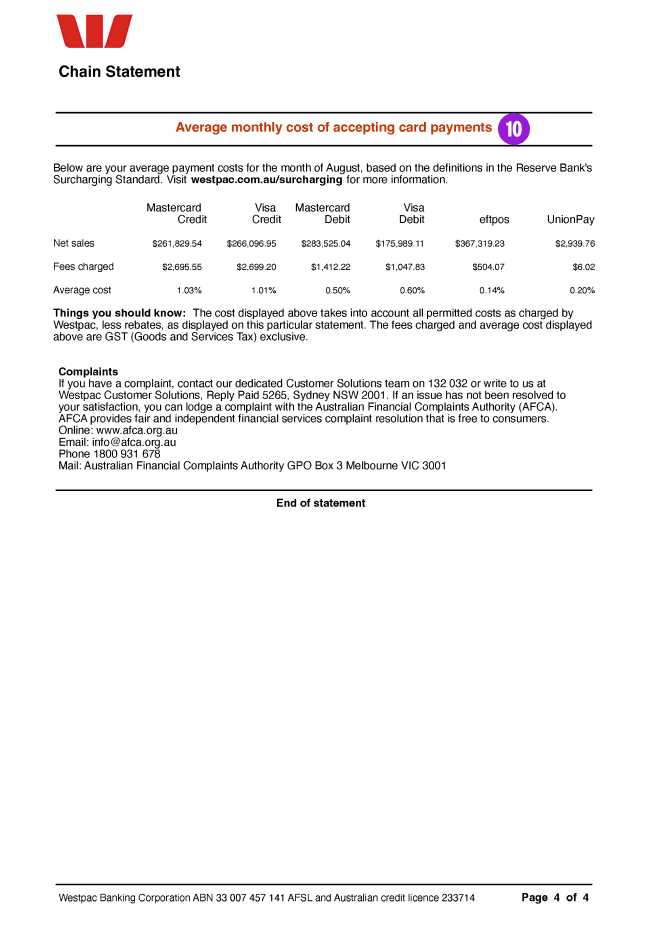

Average monthly cost of accepting card payments

Your June monthly statement, issued in early July each year, will include two tables which show how much you are being charged to process payments for the different card types. One table will show you your monthly cost of accepting card payments and the other table will show your average annual cost of accepting card payments by card type.

The amount shown is the maximum percentage surcharge you will be able to apply to a customer’s transaction if they pay by card. If a payment surcharge is applied, you will need to provide adequate disclosure to the customer and be clear about the nature of the fee and the circumstances in which it applies before processing a transaction.

For an example of how this table will display on your merchant statement, go to cost of accepting card payments.

Need more information?

Read your guide to Merchant Fees and Charges.

Things you should know

1. Applications for merchant services are subject to approval. Terms and conditions and fees and charges apply. Full details are available on request.

2. AMEX transactions are not included in merchant statements and are invoiced separately.

3. UnionPay is only included for EFTPOS Connect, PayWay, Quickstream and Quest QT720 products

Mastercard® is a registered trademark of Mastercard International Incorporated. American Express is a trademark of American Express. Visa is a registered trademark of Visa International Service Association. JCB is a registered trademark of JCB International. UnionPay is a registered trademark of UnionPay International Co., Ltd.

Information should be read in conjunction with your Fee Schedule and Merchant Fees and Charges Brochure (PDF 105KB). This advice has been prepared without considering your objectives, financial situation or needs. Before acting on the advice, please consider if it’s right for you. Bank fees and charges may apply. Download the Card Acceptance by Business Terms and Conditions (PDF 715KB) for more information.