Goal savings account

Why open a Life account?

- Bucket your savings in up to 6 different Savings Goals with just one account

- Set Savings Goals to track how much you should save to reach your goal

- You could give savings a boost with bonus interest each month you grow your balance

- Keep your spending and savings separate, but visible in one view with the Westpac App.

Interest rates

Earn up to:

4.75% p.a. Total variable interest rate |

0.40% p.a. Standard variable base rate |

The total variable interest rate is a combination of:

| Standard variable base rate (when no standard variable bonus rate applies) | 0.40% p.a. |

| Standard variable bonus rate | 4.35% p.a. |

| Interest is calculated daily on your account balance up to the second last business day of the month. Interest is paid into the account on the last business day of the month. | |

To earn bonus interest on a Westpac Life account over the month:

- Keep your account balance above $0 at all times

- Make a deposit into the account. Interest paid into the account doesn’t count

- Your balance must be higher at the end of the month than at the beginning.

A month is from the end of the last business day of the previous month to the end of the last business day of the current month. By the end of the business day, we mean 11:59pm on any weekday from Monday to Friday, excluding weekends and national public holidays.

After 11:59 pm on the last business day of the month, any transactions processed before this time may affect whether you qualify for the bonus interest.

Turbocharge your balance with Savings Goals

Set up to 6 Savings Goals

Change the savings amount, date, and category across all your goals. Adjust them at any time in the Westpac App.

Put savings on autopilot

Set up recurring transfers from your transaction account on paydays to automatically split your savings across your goals.

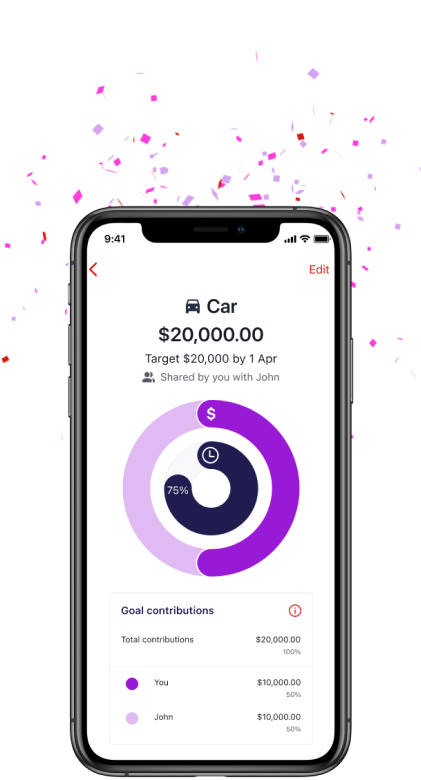

Invite others to join your goal

Share your goal with another Westpac customer. Or invite anyone to contribute by sending money to your account.

Open your account online

In just minutes you can open online your:

- Westpac Life savings account

- A linked Westpac Choice account (if you don't already have one).

Your personal details:

- Name and date of birth

- Australian home address

- Mobile number

Two forms of ID:

- Australian birth certificate

- Australian driver licence

- Passport

- Medicare card

Get your ID verified instantly online, without going into a branch.

If you're an Aboriginal or Torres Strait Islander and don't have any of the required forms of identification, please call our Indigenous Call Centre on 1800 230 144 Monday to Friday 9am - 6.30pm ACST or visit your nearest branch.

Get the Westpac App for even easier banking

View and transfer funds fast

Quick Balance lets you view balances and transfer money for up to three main accounts without signing in.

Set and track savings goals

Account holders and authorised users can use the Savings Goals feature, adding up to 6 goals on a Westpac Life or Bump account. View, edit, delete, or even share goals with family and friends to reach your goals sooner.

Get sorted with in-app budget tools

Track your month-to-month Cash flow with the in-app budget tools. Spot areas where you could save by sorting your spending into Categories.

Account fees

To open a Westpac Life savings account, you must:

- Hold a Westpac everyday account in the same name

- Be registered for Online and Telephone Banking.

Fees and charges may apply on the everyday account, including a $5 monthly account-keeping fee.

| Standard fees (fees may change) | Amount |

|---|---|

| Account-Keeping Fee (monthly) | $0 |

| Online Banking withdrawal (including Mobile Banking) | $0 |

| Telephone Banking withdrawal (self service) | $0 |

| Telephone Banking withdrawal (staff assisted) | $0 |

| Branch staff assisted withdrawal | $0 |

| Overdrawn Fee | N/A |

Other fees and charges may apply. Please refer to the Terms and Conditions (PDF 712KB)

Safe and secure savings

- Online Banking Security Guarantee: If your Westpac account is compromised by online banking fraud, we promise to return any missing funds. This guarantee only applies if you’ve followed our Online Banking Terms and Conditions. This includes: 1. Keeping your sign-in details, including passwords or Westpac Protect™ Security codes, private, 2. Not contributing to the loss, and 3. Telling us right away if you think there’s an unauthorised transaction or fraud on your account.

- Westpac Protect™ Security Code: Keep your Online Banking safe with a Security Code when using the Westpac App or your Online Banking service. This Security Code confirms that it's you transacting or making changes to your profile.

- Protected by the Financial Claims Scheme (FCS): If you have a Westpac deposit account, in certain circumstances you may be entitled to a payment under the FCS. Payments under the FCS are limited for each customer. You can find out more information from the APRA website at www.fcs.gov.au.

Frequently asked questions

Bonus interest is payable each month that you:

- Make a deposit to the account;

- Ensure your account balance is higher at the end than the beginning; and

- Keep your account balance above $0 at all times.

If you don’t meet the criteria for the bonus interest each month, you’ll still earn the standard variable base interest rate.

We define a month as: from the end of the last business day of the previous month to the end of the last business day of the current month. By the end of the business day, we mean 11:59pm on any weekday from Monday to Friday, excluding weekends and national public holidays.

Bonus interest is calculated: after 11:59 pm on the last business day of the month. Any transactions processed before this time may affect whether you qualify for the bonus interest.

Help when you need it

Things you should know

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

Registered to BPAY Pty Ltd ABN 69 079 137 518.

Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Google Pay™ is a trademark of Google LLC.

Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co.