Everyday banking + up to 5.00% P.A. on savings

Why open a Life and Choice account together?

- $0 monthly fees for account holders under 30 or full-time tertiary students

- Separate spending and saving for simple money management

- You could earn bonus interest each month you grow your savings

- Use the debit card linked to your Choice account 5+ times per month for Spend&Save bonus interest.

Interest rates

On your Westpac Life savings account earn up to:

5.00% p.a. Total variable interest rate |

0.40% p.a. Standard variable base rate |

The total variable interest rate is a combination of:

| Standard variable base rate (when no standard variable bonus rate applies) | 0.40% p.a. |

| Standard variable bonus rate | 4.35% p.a. |

| Spend&Save variable bonus rate | 0.25% p.a. (on up to $30,000) |

Interest is calculated daily on your account balance up to the second last business day of the month. Interest is paid into the account on the last business day of the month.

How do I earn bonus interest?

- Keep your account balance above $0 at all times

- Make a deposit into the account. Interest paid into the account doesn’t count

- Your balance must be higher at the end of the month than at the beginning.

A month is from the end of the last business day of the previous month to the end of the last business day of the current month. By the end of the business day, we mean 11:59pm on any weekday from Monday to Friday, excluding weekends and national public holidays.

After 11:59 pm on the last business day of the month, any transactions processed before this time may affect whether you qualify for the bonus interest.

It pays to shop with ShopBack in the Westpac App

Earn Cashback on over 4,000 brands with ShopBack. Link an eligible Westpac debit or credit card for special deals and Bonus Cashback when you shop online or in-store. T&Cs apply.

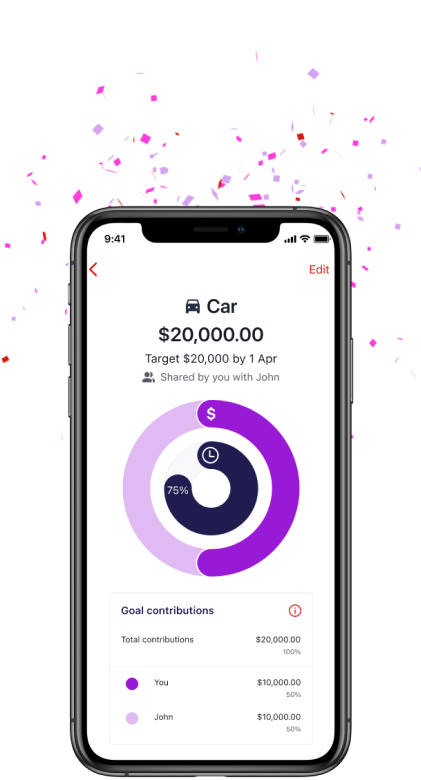

Join forces to turbocharge your savings

Collaborate on your Savings Goals by teaming up with an eligible Westpac account holder. Create a shared goal or add them to an existing one. You can even request contributions from other people for an added boost to savings.

Open your accounts online

In just minutes you can open online your:

- Westpac Life savings account

- A linked Westpac Choice account.

Your personal details:

- Name and date of birth

- Australian home address

- Mobile number

Two forms of ID:

- Australian birth certificate

- Australian driver licence

- Passport

- Medicare card

Get your ID verified instantly online, without going into a branch.

If you're an Aboriginal or Torres Strait Islander and don't have any of the required forms of identification, please call our Indigenous Call Centre on 1800 230 144 Monday to Friday 9am - 6.30pm ACST or visit your nearest branch.

Learn how to make the most of your money

You don’t often really get taught how to use money in everyday life. We’ve teamed up with Year13 to give you the rundown on earning, spending, and saving your money in the big wide world.

Get the Westpac App for even easier banking

View and transfer funds fast

Quick Balance lets you view balances and transfer money for up to three main accounts without signing in.

Set and track savings goals

Account holders and authorised users can use the Savings Goals feature, adding up to 6 goals on a Westpac Life or Bump account. View, edit, delete, or even share goals with family and friends to reach your goals sooner.

Get sorted with in-app budget tools

Track your month-to-month Cash flow with the in-app budget tools. Spot areas where you could save by sorting your spending into Categories.

Account fees

To open a Westpac Life savings account, you must:

- Hold a Westpac everyday account in the same name

- Be registered for Online and Telephone Banking.

Fees and charges may apply on the everyday account, including a $5 monthly account-keeping fee.

| Standard fees (fees may change) | Amount |

|---|---|

| Account-Keeping Fee (monthly) | $0 |

| Online Banking withdrawal (including Mobile Banking) | $0 |

| Telephone Banking withdrawal (self service) | $0 |

| Telephone Banking withdrawal (staff assisted) | $0 |

| Branch staff assisted withdrawal | $0 |

| Overdrawn Fee | N/A |

Other fees and charges may apply. Please refer to the Terms and Conditions (PDF 712KB)

Safe and secure banking

- Online Banking Security Guarantee: If your Westpac account is compromised by online banking fraud, we promise to return any missing funds. This guarantee only applies if you’ve followed our Online Banking Terms and Conditions. This includes: 1. Keeping your sign-in details, including passwords or Westpac Protect™ Security codes, private, 2. Not contributing to the loss, and 3. Telling us right away if you think there’s an unauthorised transaction or fraud on your account.

- Westpac Protect™ Security Code: Keep your Online Banking safe with a Security Code when using the Westpac App or your Online Banking service. This Security Code confirms that it's you transacting or making changes to your profile.

- Fraud Money Back Guarantee: Shop securely using your Debit Mastercard or Credit Card, backed by 24/7 fraud monitoring and our Fraud Money Back Guarantee. Westpac promises to return any missing funds to you if you've not contributed to the loss and contact Westpac right away. Check your card’s terms and conditions for full details.

- Card Lock: Can’t find your card? Sign into the Westpac App or Online Banking and select 'Lock a card temporarily' under Cards services on your eligible personal credit or debit card. You can search for your card knowing that your account is safe. Then, if you can’t find it, report it lost or stolen.

Frequently asked questions

If you have more than one Life account, you can earn the:

- Standard variable bonus rate on all your Life accounts. This bonus is for growing your balance each month

- Spend&Save variable bonus rate only on the first Life account that you opened. This bonus is for making 5+ eligible purchases per month.

Help when you need it

Things you should know

Registered to BPAY Pty Ltd ABN 69 079 137 518.

Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Google Pay™ is a trademark of Google LLC.

Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co.

PayPass is a trademark of Mastercard International Incorporated.

PayID® is a registered trademark of NPP Australia Limited.