Everyday banking + up to 5.20% P.A. on savings

Why open a Life and Choice account together?

- $0 monthly fees for account holders under 30 or full-time tertiary students

- Separate spending and saving for simple money management

- Earn bonus interest each month you grow your savings 1

- Use your debit card 5+ times per month for Spend&Save bonus interest 2

Interest rates

On your Westpac Life savings account earn up to:

5.20% p.a. Total variable interest rate* |

1.85% p.a. Standard variable base rate |

The total variable rate is a combination of:

| Standard variable base rate (when no standard variable bonus rate applies) | 1.85% p.a. |

| Standard variable bonus rate1 | 3.15% p.a. |

| Spend&Save variable bonus interest rate2 | 0.20% p.a. (on up to $30,000) |

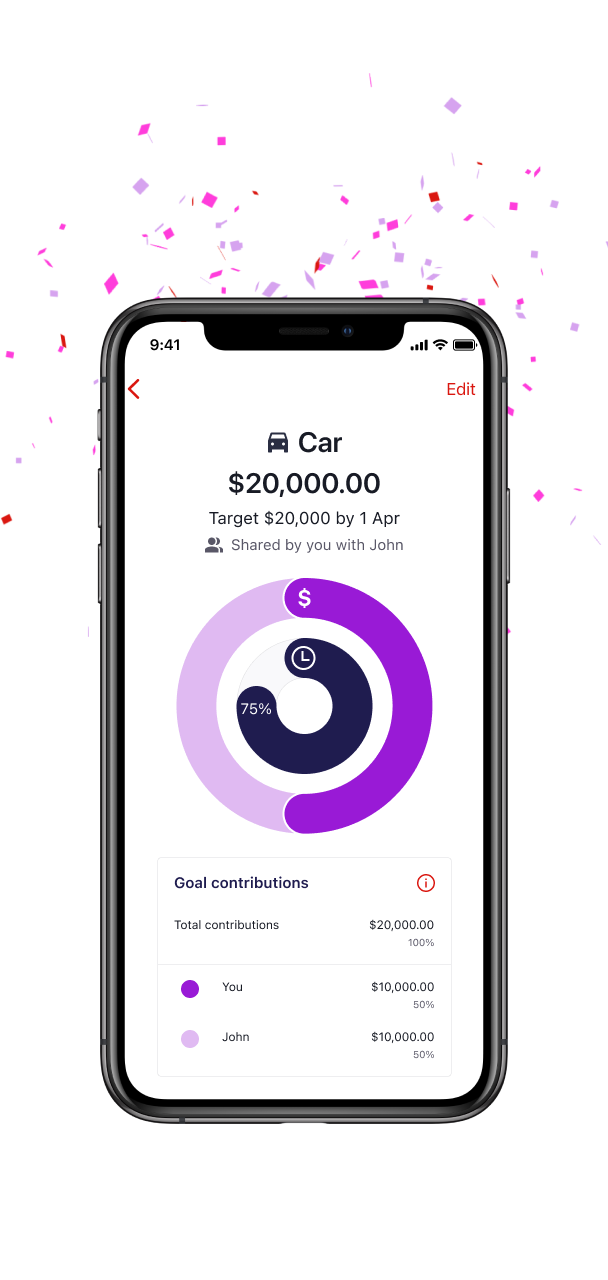

Join forces to turbocharge your savings

Collaborate on your Savings Goals by teaming up with an eligible Westpac account holder, creating a shared goal or adding them to an existing one. You can even request contributions from other people for an added boost to savings.

Two accounts, linked to simplify your banking

Westpac Life

A savings account to help you reach your savings goals sooner by earning bonus interest every month you increase your balance.

plus

Westpac Choice

A simple-to-use everyday account packed full of features, including a Debit Mastercard® designed to help you bank with ease.

Safe and secure banking

Learn how to make the most of your money

You might learn about econ or maths in school, but nobody ever really teaches you how to actually use money in everyday life. That’s why we’ve teamed up with Year13 to give you the rundown on earning, spending, and saving your money in the big wide world.

Get the Westpac App for even easier banking

View and transfer funds fast

Quick Balance lets you view the balance of three main accounts and quickly transfer money without signing in.

Set and track savings goals

Set up to 6 savings goals for things that matter to you, like saving for a home deposit or a holiday. You can even share goals with family and friends to boost savings, tracking your progress with Savings Goals.

Get sorted with in-app budget tools

Track your month-to-month Cash flow and spot areas where you could be making savings with your spend sorted in Categories.

Account fees

| Fees | ||

|---|---|---|

| Westpac Life savings account | $0 | |

| Westpac Choice bank account3 | $5 (criteria for fee waiver below) | |

This fee is waived for:

|

|

Other fees and charges may apply. Please refer to the Terms and Conditions (PDF 622KB)

Help when you need it

Things you should know

Apple Pay Terms and Conditions (PDF 42KB)

Samsung Pay Terms and Conditions (PDF 63KB)

- You must be aged 18-29 with a Westpac Life and a Westpac Choice account. Joint accounts are not eligible.

- If you have multiple Westpac Life accounts, only the earliest opened account is eligible for bonus interest qualification.

- You must make 5 eligible purchases with the debit card linked to your Westpac Choice account and have these settled (not pending) by 11:59PM AEST on the second last business day within a calendar month. The following transactions are ineligible: ATM transactions, PayID, BPAY, EFTPOS cash-out only transactions, direct debits and paying off a credit card account.

- For bonus interest qualification, a month is the period from close of business on the last business day of the prior month to close of business on the last business day of the current month. Bonus interest is calculated on the daily balance of your eligible Westpac Life account up to $30,000, and recorded as paid into your eligible Westpac Life account on the last business day of the month.

- Only one Spend&Save bonus variable interest offer per customer.

- The bonus interest will appear on your Life account statement as “INTEREST PAID – PROMOTIONAL". It will also appear in Online Banking and the Westpac App in the Account details section for your Westpac Life account as “Promotional rate”.

- Offer may be varied or withdrawn at any time in accordance with the Deposit accounts for Personal customers Terms and Conditions. (PDF 622KB)

^ Safe Online Banking guarantee: ensures that customers will be reimbursed for any unauthorised transactions provided that the customer has not contributed to the loss and contacted Westpac promptly. Refer to the Westpac Online Banking Terms and Conditions (PDF 407KB) for full details, including when a customer will be liable.

+ Westpac Fraud Money Back Guarantee: Customers will be reimbursed for any unauthorised transactions provided that the customer has not contributed to the loss and contacted Westpac promptly.

Registered to BPAY Pty Ltd ABN 69 079 137 518.

Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Google Pay™ is a trademark of Google LLC.

Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co.

PayPass is a trademark of Mastercard International Incorporated.

PayID® is a registered trademark of NPP Australia Limited.