Investing in property

Your investment property plans

Investing in houses, units & land

Let’s inspect some of the pros and cons of buying a house, unit, townhouse, house & land package.

Building your dream team

Surround yourself with a crew of investment professionals to access a tailored rate, expert tax advice and off-market viewings.

Structuring ownership

Consider the tax, legal and relationship implications of buying in your own name, with others, a business name or a trust.

What kind of investment property loan are you looking for?

Negotiate your rate

One conversation could save you 1000s

Book an appointment with a dedicated lending specialist or start applying online and we'll be in touch. We can tailor a variable investor rate with offset, just for you.

Steps for investing in property

1. Borrowing power

Get a ballpark range, by knowing how much you could borrow, based on simple questions about your income and expenses.

2. Savings and equity

Firm up your deposit. Buying another place? You could borrow against your equity – the portion you own of your property.

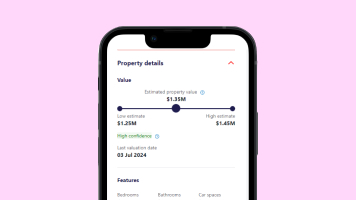

3. The research

Get to know the property and its suburb in seconds: the median gross rental yield, nearby rentals and sales.

4. Conditional approval

Get an obligation-free snapshot of your rate and repayments. A lender will call you back – you could get pre-approval.

What's your property investment stage?

Property investor calculators and guides

Property investment FAQs

Generally, you'll need at least 20% deposit (80% loan-to-value ratio) for the property purchase. This can come from your savings or equity from your existing home. You may need to pay lenders mortgage insurance (LMI) if your deposit’s lower than 20%.

Certain medical practitioners can apply for our LMI waiver with a min 5% deposit. And certain emergency services and healthcare practitioners, earning a minimum annual income of $90,000, can apply for our LMI waiver with a min 10% deposit.

Things you should know

Conditions, credit criteria, fees and charges apply. Residential lending is not available for Non-Australian Resident borrowers.

This information is general in nature and has been prepared without taking your objectives, needs and overall financial situation into account. For this reason, you should consider the appropriateness of the information and if necessary, seek appropriate professional advice. This includes any tax consequences arising from any promotions for investors and customers should seek independent, professional tax advice on any taxation matters before making a decision based on this information.

#Premier Advantage Package: Conditions of Use and $395 annual package fee applies. You must either hold or be approved for a Westpac Choice transaction account in order to qualify and continue to receive the benefits of the Premier Advantage Package. Applicants must have a Westpac Choice transaction account linked to the home loan at the time of settlement and must keep this account open for 60 days after settlement. Before deciding to acquire a Westpac Choice account, read the terms and conditions, and consider whether the product is right for you. Tax consequences may arise from this promotion for investors and customers should seek independent advice on any taxation matters.

Premier Advantage Package Conditions of Use (PDF 295KB)

^Claim based on The Forrester Digital Experience Review™: Australian Mobile Banking Apps, 2024 evaluation of four Australian Banks.

1Redraw facility: if you have ‘available funds’ (you’ve made extra home loan repayments) and you’ve activated your redraw facility, you’re free to redraw them with no redraw fee. Up to $100k will be available to redraw from your variable loan online or over the phone each day (unlimited in-branch). For fixed loans you can redraw up to your prepayment threshold during your fixed term. Read our Home Loan Redraw Authority form (PDF 66KB) for full details.

2Interest Only in Advance: Interest must be paid in advance annually for each chosen fixed rate term to receive this rate. If after the first year of a fixed rate term interest is no longer paid in advance the Interest Only in Advance discount will be removed for subsequent years.

Interest Only in Advance interest rates are available on Fixed Rate Investment Property Loans with fixed rate terms of 1, 2, 3, 4 or 5 years.

Interest Only in Advance interest rates and discounts apply to new Fixed Rate Investment Property Loan and loans which have been switched into Interest Only in Advance products. Existing fixed loans are not eligible unless the loan is re-fixed. Interest Only in Advance discounts are subject to change. Subject to Bank's approval. Normal lending criteria apply. Other conditions, fees and charges apply.

4Interest Only repayments: Conditions apply. It’s important to understand that interest rates for loans with Interest Only repayments are higher. Your repayments will increase at the end of the Interest Only term as the amount you’ve borrowed will need to be paid back in a shorter timeframe. This also means you’ll pay more interest over the life of the loan with an Interest Only repayment term, than if you’d opted to continue paying principal and interest. There’s a maximum of 5 years for Owner Occupied loans and 10 years for Investment loans on Interest Only repayments over the life of the loan. If you’ve had less than this, you may be able to extend the Interest Only repayment term, subject to conditions and a new assessment. You’ll need to start the process well in advance of your expiry date and provide details of your income, expenses and liabilities.