Savings Account for Kids and Teens

Watch your piggy bank grow with Westpac Bump

Zero monthly fees

No Account-keeping or transaction fees7, so every dollar will help your savings grow.

Rewards for savers

Make regular deposits to grow your savings and get rewarded with bonus interest2.

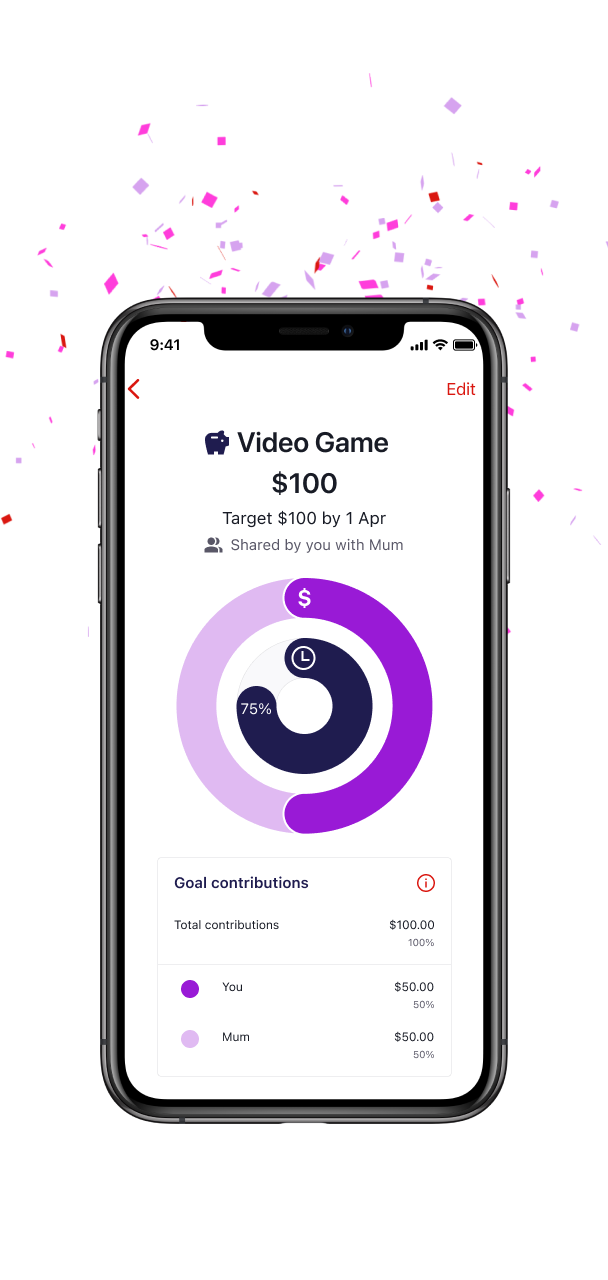

Set and share savings goals

Having clear savings goals3 you share with others may motivate you to strive to save even more

Keep tabs on spending

Open with an everyday account to track both your savings and spending in the Westpac App.

Under 18? Get $30 on us

Open a Choice Youth everyday account with a Bump savings account, so you have one of each account. Deposit at least $100 into your savings within 30 days, and we’ll give you $30. T&Cs apply.

Interest rates

Earn interest of up to:

4.75% p.a. Total variable interest rate1 |

1.75% p.a. Standard variable base rate |

The total variable rate is a combination of:

| Standard variable base rate (when no standard variable bonus rate applies) | 1.75% p.a. |

| Standard variable bonus rate2 | 3.00% p.a. |

How do I open a kids savings account?

You can open a Bump account online now. We'll ask for your name, date of birth and a few other details, along with a form of ID.

As the account holder, you can decide if you want your parent or guardian to have access to your accounts with the Parental Control4 function.

Two forms of ID:

- Australian birth certificate

- Australian driver licence

- Passport

- Medicare card

8 or older? Get a Debit Card to easily access your money

Get the Westpac App for even easier banking

View and transfer funds fast

Quick Balance lets you view the balance of three main accounts and quickly transfer money without signing in.

Set and track savings goals

Set up to 6 savings goals for things that matter to you, like saving for a new bike, clothing or holiday spending money. You can even share goals with family and friends to boost savings, tracking your progress with Savings Goals.

Get sorted with in-app budget tools

Track your month-to-month Cash flow and spot areas where you could be making savings with your spend sorted in Categories.

Account fees

Funds can be withdrawn from a Bump Savings account via online transfers to a Westpac everyday account5 held by the Bump Savings account holder or an account signatory, or by visiting a branch. There are no fees for these withdrawals. Other fees may be charged for banking services. Direct debits, periodical payments, BPAY®, Pay Anyone, cheque withdrawals and ATM transactions are not available from a Bump Savings account. Telephone Banking is not available for a parent signatory6, and self service Telephone Banking is not available for children under 12.

Other fees and charges may apply. Please refer to the Terms and Conditions (PDF 712KB) |

Frequently asked questions

Make a monthly deposit into the account (by the last business day of the current month), ensuring your balance always stays above $0 and is higher than the account balance on the last business day of the previous month.2

Important: any interest earned and credited to the account does not count as a monthly deposit.

Things you should know

1. Westpac Bump variable interest: includes a standard variable base rate plus a variable bonus rate. Interest is calculated on the daily balance of your Westpac Bump account and paid on the last business day of the month. For the purpose of calculating interest paid, a month is the period between the last business day of the previous month to the second last business day of the month (inclusive). Therefore, interest calculated on closing balances on and after the last business day of a month won't be included in the interest payable for the month but will be included in the interest payable for the next month.

a. your account balance has not fallen below $0; and

b. you (or someone on your behalf) have made a deposit of any amount (interest paid into your account does not qualify as a deposit in terms of bonus interest eligibility); and

c. the account balance on the last business day of the month is higher than the account balance on the last business day of the previous month.

Note: Bonus interest is calculated in the system after 11:59pm on the last business day of the month. Any transaction processed before 11:59pm may impact bonus interest eligibility.

9. Westpac Fraud Money Back Guarantee: ensures that customers will be reimbursed for any unauthorised transactions, provided that the customer has not contributed to the loss and contacted Westpac promptly. Refer to the Westpac Debit Mastercard Terms and Conditions for full details, including when a customer will be liable.

Mastercard® is a registered trademark and the circles design is a trademark of Mastercard International Incorporated.