What is a mortgage repayment calculator?

How a mortgage repayment calculator works, how to use it, and the essential information it can provide about your home loan.

How a mortgage repayment calculator works, how to use it, and the essential information it can provide about your home loan.

When you take out a home loan, it’s almost always a sizable financial commitment. So it’s important to understand the full costs associated with the loan, how it’s structured, and how it reduces over time.

A home loan calculator works out your repayments for a mortgage by crunching the numbers you put in. You enter the details of a loan in to get a result. The four vital data points are:

With all these data points entered into the home loan calculator, it will show regular repayment amounts, and break down all the repayments over the life of the loan. It will also show you how much interest you will pay over the whole loan. These calculations will be estimates only, so they can provide a guide. You will get exact costs when you complete a full home loan application.

A mortgage repayment calculator is a great tool for seeing the impact of various scenarios. Here’s an example:

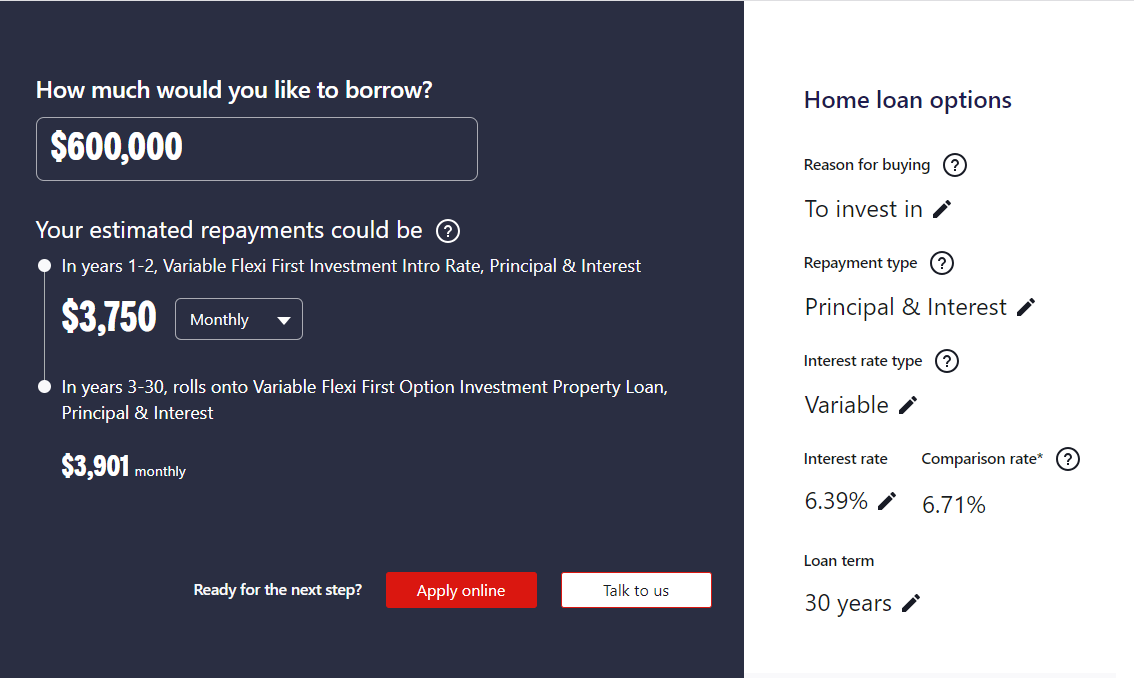

You plan to buy a house with a value of $750,000. You have a deposit of $150,000, or 20% of the purchase price. Your loan will cover the remaining $600,000, which is 80% of the house price.

Using this information, the mortgage calculator shows what your repayments could be each month. (Use the dropdown menu to show weekly or fortnightly repayments.)

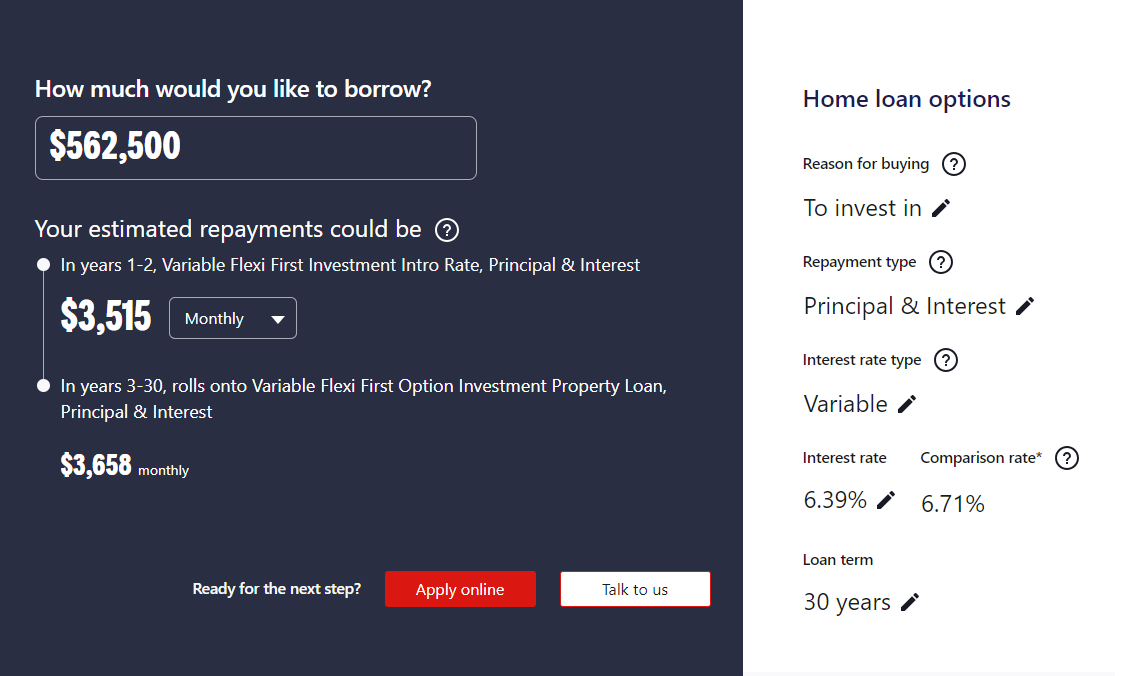

By adjusting the variables, you can see the impact of different changes. For example, if you had a 25% deposit ($187,500), your loan would be $562,500, so your repayments would be lower:

Or, if you reduce the term of the loan from 30 years to 25 years, you would be mortgage-free five years earlier, but your repayments would be higher:

Remember that the online calculator provides estimates of your likely costs. Exact costs, including fees and charges, will be made available to you once you complete a full home loan application.

There are some variables that might be useful in certain circumstances.

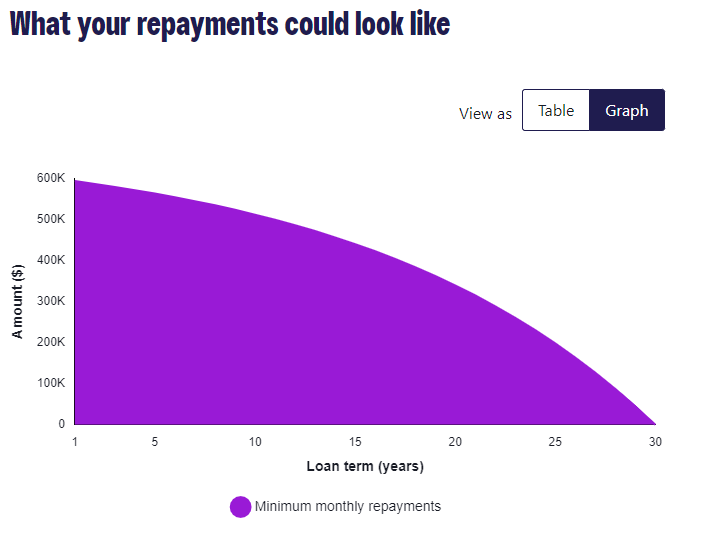

The section below the repayments calculator shows how your loan is paid off over time, broken down so you can see the full interest costs. There are two options to display this information:

Here’s what the graph view looks like for the 30-year, $600,000 loan, when you hover over year 1:

And here’s the same information presented in table form, for years one and two (although all years are included if you use the arrows to move through the full table):

When you make regular extra repayments on your loan, it can have a big impact on the lifetime cost and time it takes to repay the mortgage. Even a single lump sum repayment can change the equation. This section of the home loan calculator allows you to play around with repayments and see what difference you can make to your loan.

For example, if you round up your mortgage repayments to the nearest hundred dollars, here’s what it looks like:

You would be mortgage-free months sooner and save in interest repayments. Use the slider to see how a larger or smaller overpayment could change the total cost and duration of your home loan.

This is an estimate for your guidance; exact calculations for your mortgage may vary depending on your individual details and any additional fees and charges.

In addition to our mortgage calculator, you can use a range of other calculators to help you analyse your home loan situation.

For example, you can estimate what size mortgage you could afford to service using this calculator: How much can I borrow?

This calculator gives you two options: affordability calculator and maximum loan calculator.

The affordability tab: this lets you enter an amount you could comfortably repay, based on what’s left over after paying all your expenses. However, when considering these expenses, you could subtract your current accommodation costs since those will stop once you move into a new house.

The maximum loan calculator tab: this asks you to enter your circumstances and outgoings, then provides you with a potential maximum home loan amount.

Credit criteria, fees and charges apply.

This information is general in nature and has been prepared without taking your objectives, needs and overall financial situation into account. For this reason, you should consider the appropriateness of the information to your own circumstances and, if necessary, seek appropriate professional advice.