October 2024

8-minute read

Key takeaways:

- Understanding the Benefits: Property investment offers potential advantages such as capital growth, rental income, and tax benefits. Historically, Australian property values have shown significant appreciation, contributing to wealth accumulation for investors.

- Developing a Clear Strategy: It's important to consider a well-defined investment strategy. This includes setting financial goals, choosing between positive or negative gearing, and deciding on the type of property that aligns with your objectives.

- Managing Financial Commitments: Investors should be prepared for ongoing costs beyond the purchase price, such as maintenance, property management fees, and loan repayments. Understanding these commitments is important for effective financial planning and ensuring the investment remains sustainable.

For a complete overview, read the full article.

Why invest in property?

There’s many reasons why investing in property continues to be a popular choice for Australian investors. Investing in property involves buying real estate with the goal of generating income and building wealth. And while property prices can go down as well as up, since 1993, median house and unit values have increased by 412% and 316% respectively. This has provided some Australian homeowners with a significant wealth boost.

Considered to be a relatively stable and lower-risk investment, purchasing an investment property also comes with a number of potential benefits, including:

- Increasing in value over time (also known as capital growth) – not guaranteed but historically common

- Income from renting the property to tenants

- Potential tax benefits

- Investing in “bricks and mortar” – a tangible asset is sometimes seen as more reliable and desirable

- Traditionally less volatile than some other investments

- Opportunity to increase the value of your investment through renovations and works on the property

With these potential benefits also comes some considerations to be aware of when deciding to invest in property

There's always a risk of investing in a property that doesn't deliver a return, or even losing money on the investment. Buying property also has a high-value entry point compared to other investments. To purchase a home the minimum investment is often hundreds of thousands of dollars and also involves most people taking on debt. This initial outlay of funds, including getting a deposit together, may be a barrier for some investors.

You should also consider whether you have the time and funds to manage your investment property. You’ll need to be in a position where you can afford the ongoing expenses (property management fees, council rates and insurance), as well as any unexpected costs that may come up, including repairs and maintenance.

Our lenders love to help!

Property investment strategies

For property investors, there are three key areas of potential: capital growth, rental income and tax benefits. When thinking about your investment strategy, it’s important to understand which of these elements – either individually or as a combination – are most important for you.

If you’re looking to buy an investment property, you’ll need a well thought out strategy. Here are six investment property strategy tips that could help you make the most of potential profits and minimise risks.

Capital growth

Capital growth is the increase in value of your investment property over time, calculated by finding the difference between the current market value and the purchase price.

For example:

- You purchased a property for $300,000 ten years ago

- It is now worth $500,000

- You have achieved $200,000 in capital growth

With any property purchase, buyers ultimately want the property’s market value to rise. You need to keep in mind, however, that capital growth is never guaranteed. Over time, markets and demand can rise and fall, and property can go up or down in value. Remember that regardless of the property’s current market value, you will still need to be able cover the costs of your home loan.

For some investors, choosing capital growth as a strategy involves holding the property long-term in order to see growth over time. Some investors choose to purchase property in areas known for reliable capital growth as their investment strategy, even if this means the property may not generate an adequate rental income to cover the costs of owning the property.

Rental yield and income

As an investor, you’re likely to rent out your property to tenants, offering an ongoing income stream. For some investors, this is the main goal – to comfortably cover all costs and provide a passive income stream. However, you’ll need to have funds to cover times when you don’t have tenants or rental income from your investment property.

Rental yield is a calculation to estimate the potential income from an investment and to compare properties. It's often calculated as either gross rental yield (a simple view) or net rental yield (a complex but more accurate view).

Gross rental yield is the amount of rental income you can receive over a year, measured against the market value of the property. It’s commonly used as a way to compare properties with different values and rental returns. There’s a quick, easy way to calculate the gross rental yield of a property – take a look at the example below or use Westpac’s Property Research Tool to look up a property and see the estimated rental yield.

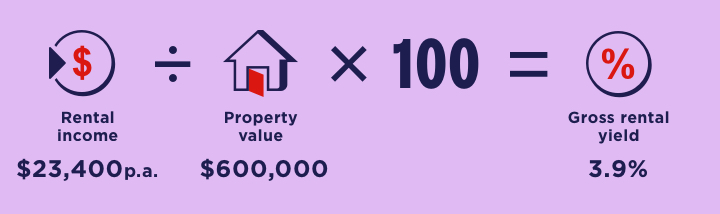

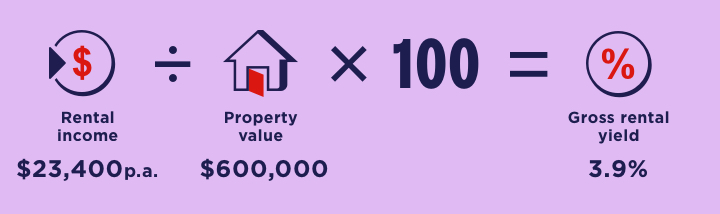

Gross rental yield example:

- George purchased an investment property for $600,000

- He rents it out at $450 per week

- The gross rental yield is the annual rental income ($450 x 52) = $23,400 / $600,000 x 100 = 3.9%

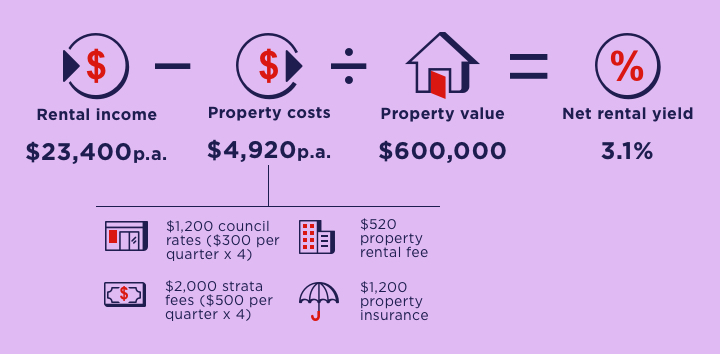

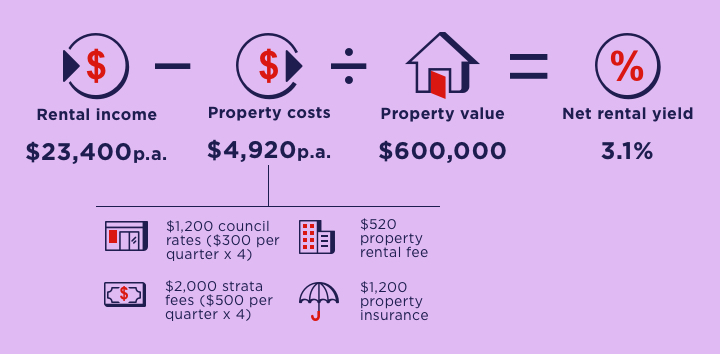

Net rental yield provides a more accurate assessment of a property’s potential. It’s a slightly more complex calculation, as it factors in all your costs and fees, such as council rates, strata levies, property management fees, depreciation, general maintenance and insurance. As these costs depend on the specific property, they can be difficult to estimate, but here’s an example of how net yield is calculated.

Net rental yield example:

- George’s net rental yield is calculated by subtracting his property costs from his rental income

- $23,400 ($450 x 52) - $4920 / $600,000 = 0.031 x 100 = 3.1%

It’s worth noting that this figure doesn’t include your home loan repayments, as that depends on individual situations. Also, the above calculation is just an example and not based on actual costs to maintain a property. Costs and calculations may vary depending on your personal circumstances.

Tax benefits

The third factor that should be considered by any investor is tax implications. As tax rules change constantly and every individual has a different financial position, we recommend you seek expert advice tailored to your situation.

Negative vs Positive Gearing

If you’re thinking about investing in property, it’s important to know about ‘gearing’: What it is, as well as the benefits and risks that come with it. In the table below we look at positive and negative gearing.

| Positive Gearing |

Negative Gearing

|

A property is positively geared when your rental income is higher than the cost of owning the property – therefore you’re making a profit on your investment. Let’s explore a real-world example. Say you receive $600 per week in rental income from your investment property – or $31,200 p.a. And your property expenses for the year come to $20,000 (things like interest repayments, insurance and repairs). Rental income ($31,200) minus property expenses ($20,000) = $11,200 Your property is positively geared by $11,200. |

A property is negatively geared when the costs of owning your investment property are higher than the rental income you receive – therefore you are essentially making a loss. Let’s bring this to life. Say you receive $300 per week in rental income from your investment property – or $15,600 p.a. And your property expenses for the year come to $20,000 (things like interest repayments, insurance and repairs).

Rental income ($15,600) minus property expenses ($20,000) = -$4,400

Your property is negatively geared by $4,400. |

Read more about gearing here: Negative gearing and investment properties.

Capital gains tax

When the time comes to sell your property, you will hopefully be selling for a higher price than your original purchase. This results in a capital gain, which needs to be reported as part of your income for that financial year when you submit your annual tax return.

If you’ve owned your investment property for more than 12 months, you may be eligible for a capital gains tax concession. Be aware that even with any concession, a capital gain could increase the amount of tax you may need to pay. Make sure you chat to your tax advisor for advice about your options.

Tax deductions

Regardless of how your property is geared, you might still be able to claim tax deductions for some of your rental property expenses, including:

- Borrowing costs including interest on your investment loan

- Council rates

- Depreciation

- Insurance

- Property management

- Maintenance (strata) and repairs|

Again, it's a good idea to discuss your tax deduction options with a professional.

Getting an investment home loan

Now that you’re across the basics of investing in property, you can start thinking about some of the practical things you may need to do to make owning an investment property a reality.

What can I afford?

Your first step is to find out what you can afford to spend on an investment property. Create a detailed budget so you can start your property search with a realistic figure in mind. Take the time to understand how much you can comfortably afford to repay, factoring in your everyday living expenses, existing debts and other financial commitments.

You’ll also need have a realistic estimate of both income and expenses for your future property investment. Get an estimate of your borrowing power based on your expected rental income and lifestyle with this calculator.

Saving a deposit

From there, you can start exploring how much you will need to save for a deposit. Generally, you’ll need 20% of the purchase price as your deposit, to avoid paying lender’s mortgage insurance (LMI). Don’t forget to factor in other significant upfront costs such as stamp duty and legal fees into your budget. If you don’t currently have a 20% deposit, there are other options available that could help you buy a property sooner – like leveraging equity in an existing property (if you have one) or paying LMI. Another way to get help to buy your first home is to use a guarantor and the Family Security Guarantee.

Equity

Many property investors choose to borrow against the equity in their existing property to help their next purchase. Equity is the difference between the current market value of your property and the remaining balance on your home loan. Equity can build up over time as you reduce your loan amount with principal and interest repayments, and if the market value of the property increases. So, if you’ve had your property for a few years, chances are you may have built up some equity that you could tap into and put towards your investment property.

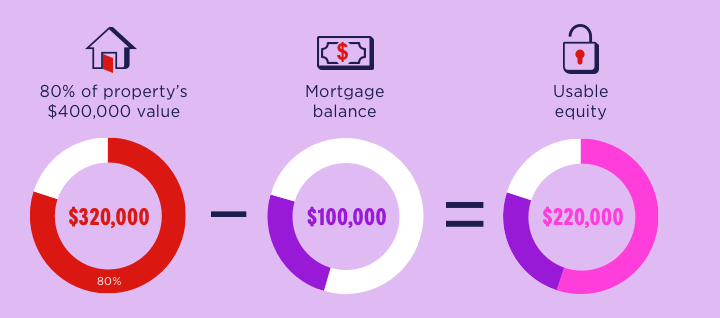

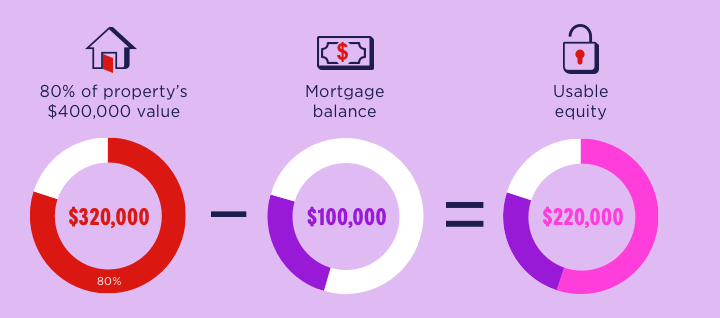

When talking about equity, there are two terms often mentioned: equity and usable equity. Useable equity is taken into consideration when applying for an investment loan. Usable equity is the equity in your home that you can actually access and borrow against. You can work out the useable equity available by calculating 80% of your property’s current value minus what is still owing on the mortgage.

Usable equity example:

You can get an estimate of your useable home equity using this calculator.

Choosing a loan

Investor loans are different to owner-occupier loans, often with different rates, terms and conditions. The type of loan you choose will depend on your investment strategy.

Fixed rate vs. variable rate loans

- Fixing your interest rate for a set period can provide repayment stability. It gives you more certainty over your repayments, making it easier to plan your budget.

- A variable interest rate can move up or down in line with market interest rates and may give you more flexibility. You can generally make additional payments and access more features (such as redraw or offset accounts) and the ability to repay your loan faster. Use our interest rate change calculator to calculate what repayments will be if interest rates change.

Principal and interest vs. interest-only loans

- Paying both principal and interest can help pay down your loan faster, so you own your investment property sooner.

- If you choose an interest-only loan, your monthly repayments will be lower for a set period as you are only paying off the loan interest – not the principal loan amount. Some investors using a capital growth strategy may choose an interest-only loan to lower their expenses while waiting for property prices to rise so they can sell.

Finding the right property

There are many factors that will influence your search for the ideal investment property – and it’s important to do your research. Investing in property is very different to buying a home to live in – while buying a home can be an emotionally-driven decision based on your personal tastes and preferences, investing is generally more rational and focused on expected returns.

When it comes to choosing a location for your investment property, you really need to do your homework. The location you decide on could potentially impact your capital growth and rental yield, so it’s important to look at up to date market data for the latest trends and insights. Most investors also consider a range of elements when choosing a location or suburb, including growth areas, future developments, lifestyle amenities, as well as proximity to schools, transport and hospitals. Once you’ve decided on a location, it’s a good idea to compare different properties in the area – making note of the rental prices and potential rental yield.

You’ll also need to decide on the type of property - apartments/units, houses or building you want to own. Your budget will play a big part in deciding on the type of property you can afford to buy, and on the flip side, the type of property will have an impact on what your rental income and yield looks like.

Using Westpac’s Property Research Tool could help you find the right property for your circumstances and investment goals.

Managing a rental property

Purchasing an investment property isn’t a ‘set and forget’ type of investment. There can be a lot of work involved to keep things running smoothly – especially when it comes to finding the right tenant and maintaining the property.

If you’re time poor or don't live close by to your investment property, you might want think about engaging a property manager or real estate agent to oversee your property. Keep in mind that this service involves property management fees and, depending on your location, can be anywhere from 3-10% of your total rental income each week. Some things property managers take care of include:

- Advertising and marketing the property

- Screening and securing tenants

- Collecting rent

- Property condition reports

- Routine inspections

- Maintenance and repair issues

- Responding to complaints/evictions.

If you’re looking to avoid paying agent fees, the other option is for you to manage the property yourself. You’ll need to have the time to dedicate to finding the right tenant, collecting rent and dealing with maintenance requests.

When it comes to managing your investment, you will need to be aware of the ongoing costs associated with your property – and have funds available in your budget to pay for these expenses.

Ongoing costs

The most common ongoing costs you may face as an investment property owner:

Council rates

Calculated on land valuations and rating categories, rates help fund local infrastructure and services. Usually paid quarterly

Body corporate/strata fees

If you are investing in an apartment or townhouse, these fees may apply. Paid by all owners, they go towards maintenance of the building's common areas, building insurance and other shared costs.

Tax

Rental income will need to be reported as part of your annual tax return.

Property management fees

If you rent your property through an agent or property manager, fees will apply.

Insurance

Landlord and/or building insurance helps protect your investment.

Utilities

While tenants are generally responsible for household utilities, you may be liable to cover some such as water.

House costs

You will be responsible for repairs and maintenance.