Tax Scams

What is a Tax scam?

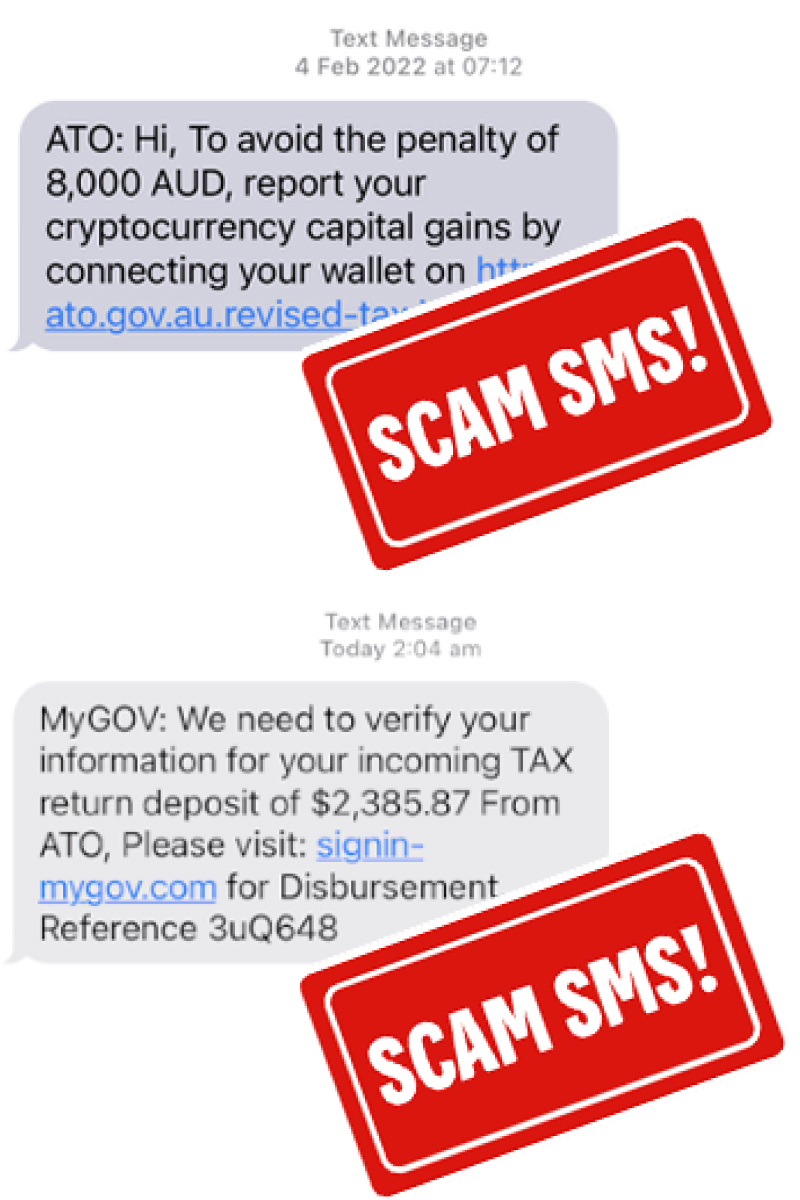

A tax scam is an email, phone call or SMS from someone claiming to be from the Australian Tax Office (ATO) or another government agency like myGov. You might be asked to give your personal details or make a payment and if you refuse, you may be threatened with arrest or legal action. Tax scammers are more prevalent at the end of the financial year.

Remember, be scam aware and never share personal or financial information, security codes or give anyone access to your devices.

Common tax scams

Tax refund

An 'ATO' refund that requires you to share personal or financial information.

Tax owed

Threats of arrest or a fine if you don't pay the scammers' tax demands.

TFN and ABN

Messages asking for your Australian Business Number (ABN) or Tax File Number (TFN).

ATO impersonator

Scammers on social media offering to help with tax and super questions.

How to spot a tax scam

Threats and urgency

Scammers put pressure on you to share personal details or pay immediately. The ATO won't do this, so hang up and contact the ATO on an independently sourced numbers from the genuine website.

Pretending to be trustworthy

Don't click on links sent via SMS or email that take you to the ATO or other government websites. Always go to the website or app directly and check for messages.

Unusual payments

If you are asked to pay using cryptocurrency, wire transfer, gift cards or to accounts other than the ATO, stay alert, this will be a scam.*

Poor grammar and spelling

Look out for SMS or emails with poor grammar and spelling and check emails, links and phone numbers are legitimate.

*Note: The ATO account details are pre-populated in your Online Banking payee list. Always use this, or payment details listed on an official letter, if you ever need to pay the ATO.

Don’t fall for phishing scams

Phishing emails and SMS impersonating the ATO or myGov are a common tax scam. Be suspicious of messages that state you are due a refund but your details need updating or that you owe the ATO and need to pay immediately.

These messages often include links that take you to fake websites that are designed to disclose your information. Always sign into your myGov or bank account directly through the App or website to check your messages.

What to do if you suspect a scam

1. Let us know

Please report scams or suspicious activity immediately. Check out our how to report page to find out how.

2. Contact the ATO

You can also contact the Australian Tax Office on 1800 008 540, go to their Verify or report a scam page, or email them at ReportScams@ato.gov.au.

3. Stay up-to-date

Keep up to date on scams by subscribing to the government's scam email alerts from scamwatch.gov.au/subscribe.

Important

Australian government agencies will never threaten you with immediate arrest, demand immediate payment through unusual means over the phone, or send you links to log in or update details for your government account (MyGov, Service Australia). If in doubt, contact your tax agent or the ATO via an independently sourced number.

Remember – never share your passwords or security codes with anyone.