Everything to know before renting or buying a house in Australia

Are you considering moving to Australia? Or eyeing a new home interstate? Or maybe you’re leaving home and searching for somewhere to rent. You’ve come to the right place.

Moving house can be stressful and expensive. But with the right information, you can make an informed decision on where you’ll settle and the funds you’ll need to make it happen.

In this guide, we’ll explore the cost of living in Australia and outline what’s involved in renting or buying a house for both Australians and those keen to call Australia home.

We’ll also do a deep dive on the best places to live in Australia, including its capital cities and regional towns, to help you narrow down your options. After all, when it comes to moving house, the more research you do upfront, the better prepared you’ll be – especially if you want to avoid a blowout in your moving budget.

If you’re looking to rent or buy a house anywhere in Australia, start by exploring areas that interest you. An easy way is to review detailed suburb profile reports covering information such as estimated property values, suburb trends and demographics. It’s also worthwhile to consider transport options in the areas you’re looking at and, if you’re working, how you’ll manage the commute. With kids, proximity to good schools is important – the Australian Government’s My School website is a great resource for information.

We’ve also included in this article a list of cities in Australia, with useful information on their climates, top employment sectors and more.

If you’re planning on renting, your rent payment will likely be one of your heftiest living expenses. And how much you’ll pay will largely depend on your location and the size of home you need. To help you find a place that suits your budget, lifestyle and needs, here are some key considerations…

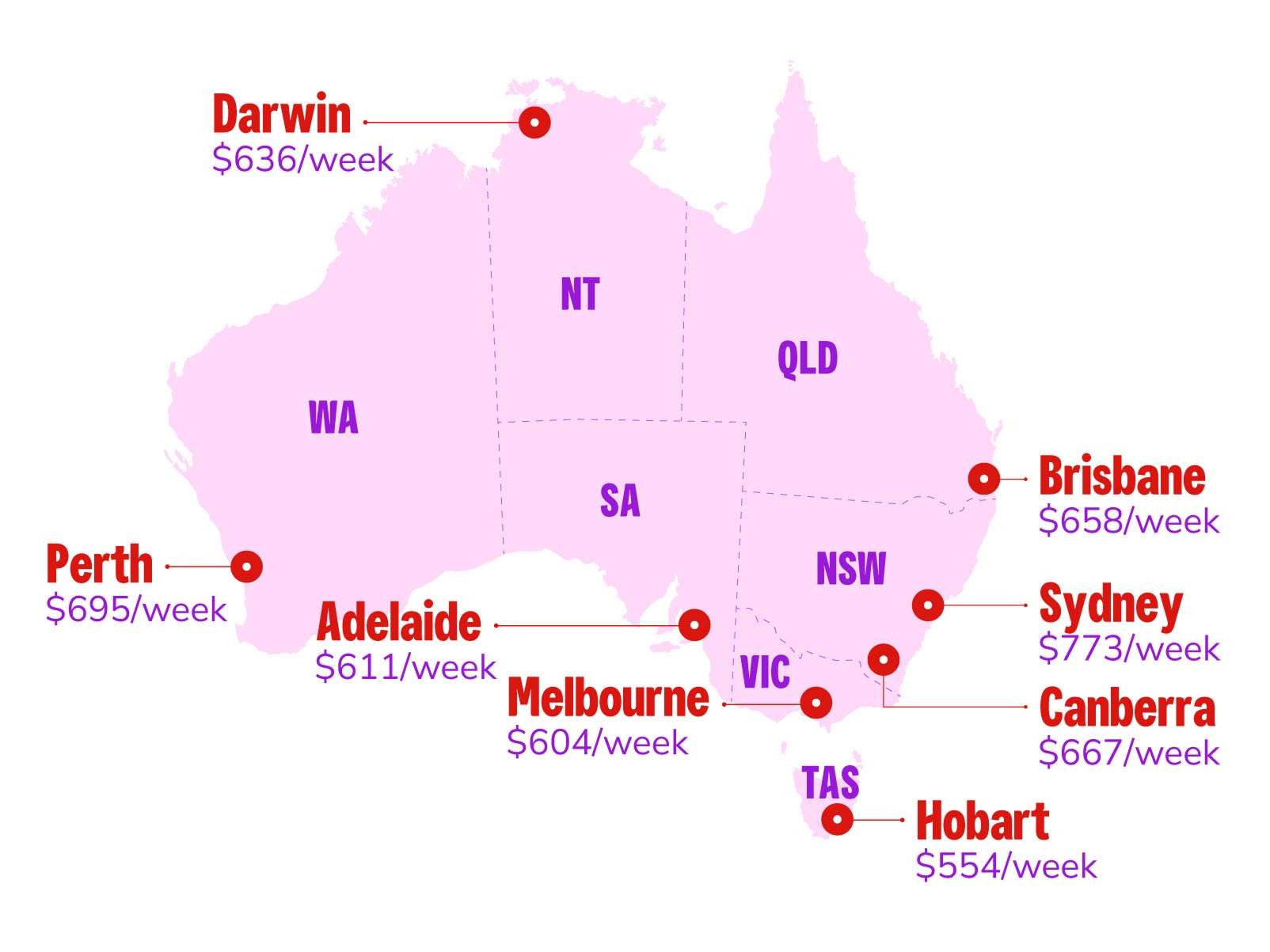

Looking for a new place or planning an interstate move? In 2025 here's what you can expect to pay for a rental home.*

*Source: CoreLogic Quarterly Rental Review, January 2025

| City | Median Weekly Rental Price |

|---|---|

| Darwin | $636/week |

| Brisbane | $658/week |

| Sydney | $773/week |

| Canberra | $667/week |

| Hobart | $554/week |

| Melbourne | $604/week |

| Adelaide | $611/week |

| Perth | $695/week |

Once you’ve found a rental property that ticks all the boxes, you can put in an application. It’s best to always assume that multiple people will be applying to rent it, so having your paperwork prepared in advance (even before inspecting the home) is a good idea.

Generally speaking, you’ll need to provide the following:

If your application is accepted, you’ll need to sign a lease and pay a deposit (usually one to four weeks’ rent), as well as a rental bond. Your bond will usually be the equivalent of four weeks’ rent, so make sure you’ve budgeted for this expense. Remember, though, you’ll get your bond back at the end of the lease – unless there’s damage to the property or unpaid rent.

Also keep in mind that rental properties in Australia tend to be unfurnished, so you’ll need to consider the cost of buying furniture or moving what you already own with you.

Managing your finances while renting is crucial to ensure you don’t fall behind in payments. To help you track your incomings and outgoings, make use of a Budget Planner – you might even identify some potential savings! The Westpac App is another great budgeting tool, letting you track your spending, split group expenses and set savings goals.

Buying your first home is a major milestone, and there’s plenty to consider and learn along the way. To help get you started, here’s some useful information on the cost of buying a property and the process involved, as well as some handy tools to simplify the process.

CoreLogic statistics released in January 2025 mark Sydney dwellings (including houses and units) as the most expensive in Australia with a median value of about $1.19m, while a dwelling in Darwin is the cheapest at about $497k median value.

Median prices land at more than $800k for a dwelling in Brisbane ($890k), Canberra ($844k), Adelaide ($814k) and Perth ($813k). A dwelling costs slightly less in Melbourne at $774k, and around $651k in Hobart.

Of course, property prices can vary within city suburbs, depending on factors such as proximity to amenities, housing type and size, crime levels and commute times. So, research widely to find a place that fits your needs and budget.

Found your dream home and want to make it yours? It’s time to start planning your finances. First, you’ll need to save a deposit – 20% of the full value of the property is a good amount to aim for.

For most people, a home loan will cover the remaining balance of the purchase price. The Australian Government’s MoneySmart website recommends considering the interest rate when looking for a good home loan deal and factoring in “breathing room” in your budget. For example, think about how your repayments would change if interest rates rose by 2% to make sure you can cover the increase.

Now for the fun part – either bid at the property auction or, if there isn’t one, simply make an offer. If buying at auction, remember that the sale is final and not subject to finance or a building/pest inspection (though you may arrange these inspections beforehand).

If you've made a conditional offer, it’s time to schedule a professional building and pest inspection to make sure the property is structurally sound and free of termites.

If everything checks out, you’ll finalise your loan, pay the deposit, set a settlement date and sign the contract – it’s a good idea to have a solicitor or conveyancer help you with this. Keep in mind, there’s also a state government property-transfer tax (stamp duty) due within 30 days of settlement.

All that’s left then is to protect your new place with home and contents insurance, and move in!

Book an appointment with one of our Home Loan Specialists for personalised guidance and make use of our Home Loan Calculators and Tools. You may even be eligible for a First Home Owners’ Grant. And don’t forget to consult a Moving House Checklist for an organised, stress-free move.

Planning on settling in Australia? Before you start searching for a home, there are laws on buying a house in Australia if you’re not a permanent resident currently living here. So, you might consider renting a house to begin with.

Moving to a new country is an exciting adventure and finding the perfect place to live is an important step in making it feel like home. Here are three tips to help you set yourself up for success.

1. Know your budget

Consider what you’ll be earning when you arrive in Australia and your day-to-day expenses (food, petrol, travel), then work out what’s left over for rent. Rental prices in Australia generally don’t include utilities such as electricity, gas and internet, so make sure you factor in these costs.

2. Prepare your documents

Be ready to quickly apply for any properties that appeal to you. Make sure you have:

3. Consider your options

House sharing – which means sharing a leased property with other tenants – could be a great way to help you get settled in Australia. Not only does this make rent more affordable, but it also gives you a chance to build your local rental history. It’s also a fun way to meet new people and create a support network. Just search the internet for a list of useful websites designed to help you find potential housemates in Australia.

Moving to Australia from abroad? You’ll need to sort out your Australian banking, which is easier than you’d think. With Westpac (Australia’s oldest bank), you can open an everyday bank account online and transfer money into your new account straight away. Just make sure you drop in at one of our branches when you arrive in Australia as you’ll need to verify your ID before you start using your new account.

To help you choose the best cities in Australia for you and your family, here’s some useful information to get you started…

If you’re looking for big city lights, proximity to world-class beaches and cultural diversity, then put New South Wales capital Sydney on your list – it sits seventh on the Global Liveability Index 2024 of the world’s most liveable cities.

With a temperate climate and plenty of sunny days, Sydney is perfect for an outdoor lifestyle. You can expect temperatures to range between an average of 18.6°C and 25.8°C in summer (December-February), and an average of between 8.8°C and 17°C in winter (June-August).

Sydney has six universities included in the QS World University Rankings for 2025, with both The University of Sydney and the University of New South Wales featuring in the global top 20.

Sydney is often voted the best Australian capital city for access to public transport. In fact, the Climate Council found that 67% of Sydneysiders have easy access to frequent public transport services. Options include light rail, ferries and buses, and you can pay using a pre-paid Opal card or any contactless-enabled credit or debit card.

The top five employing industries in Sydney are health care and social assistance; retail trade; construction; professional, scientific and technical services; and manufacturing.

There’s more to Australia than just its capital cities and plenty to love about life in its smaller cities and towns. Top of the list: housing affordability. Both renting and buying can be more affordable outside of busy city centres where there tends to be less competition for housing. Here are some other locations to consider:

Located about an hour’s drive from Brisbane in Queensland, the Gold Coast is known for its stunning beaches and thriving tourism industry. Over 50 kilometers of coastline make it a mecca for surfing, snorkelling and swimming.

Sunseekers love the Gold Coast for its sub-tropical climate and 300 days of sunshine per year. Summer average temperatures range from 21°C to 28.4°C and the days can get sticky with humidity around 75-96%. In winter you can expect a more mild average of around 12.5°C to 21.5°C.

Choose from three major universities – Griffith University, Bond University (Australia’s first and largest private university) or Torrens University. The Gold Coast campus is Griffith University’s largest.

Whether you’re on your way to work or study, attending a major event or exploring the city as a visitor, getting around is simple and affordable. Transport options include bus, train, tram and ferry services – and in 2025 fares cost only 50c per journey, no matter how far you travel. Pay using a pre-paid GoCard or any contactless-enabled credit or debit card.

The top five employing industries in the region are health care and social assistance; construction; retail trade; accommodation and food services; and education and training.

Book an appointment and a dedicated lender will get back in touch with you within 1 business day. They’ll answer your questions about home loans and guide you through next steps. Your lender will be able to start the application for you.

This information does not take into account your personal circumstances and is general in nature. It is intended as an overview only and it should not be considered a comprehensive statement on any matter or relied upon as such.