Understanding your Landlord Insurance cover

Important notice

This is a summary of key features of Westpac Landlord Insurance, provided by Allianz. It doesn’t provide a complete statement of the cover offered, exclusions, conditions and limits that may apply. You should read the Product Disclosure Statement for more details on cover and exclusions.

Product Disclosure Statement (PDS) (PDF 1MB)Product Disclosure Statement (PDS) (PDF 1MB)

What’s covered?

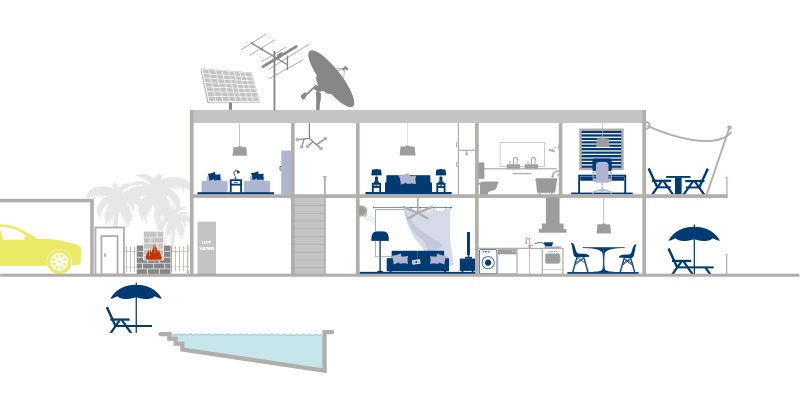

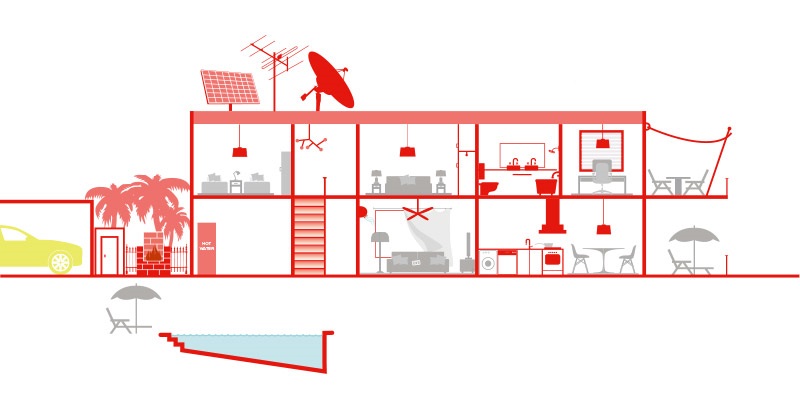

Building insurance is designed to cover the physical structures and fixtures that make up your buildings. This includes the house, garage, fences and paved driveways - even built-in appliances such as hot water systems, air-conditioners and more.

Refer to page 24 of the Product Disclosure Statement (PDS) (PDF 1MB)Refer to page 24 of the Product Disclosure Statement (PDS) (PDF 1MB)

![]() Covered by Building insurance

Covered by Building insurance

![]() Covered by Contents insurance

Covered by Contents insurance

Additional benefits

This is a summary of included additional benefits. These benefits are added to your sum insured amount or are explained below. For full details of what is covered and limitations, please refer to the relevant page in the Product Disclosure Statement.

Refer to page 28-38 and 37-40 of the Product Disclosure Statement (PDS) (PDF 1MB)Refer to page 28-38 and 37-40 of the Product Disclosure Statement (PDS) (PDF 1MB)

Optional cover

(at an extra cost)

This is a summary of the optional cover you can choose to add to buildings or contents insurance, for an additional fee.

Available for both Buildings and Contents cover.

If you have this cover, your loss of rent due to the occurrence of one or more of the following insured events listed below will be paid for up to a maximum amount of $10,000, for the periods stated in the Product Disclosure Statement:

- Default of payment of rent by the tenant

- Death of a sole tenant

- Tenant hardship

- Theft by tenant.

What may not be covered

You may not be covered for damage caused by, or to, items that have not been well maintained. For example, if a storm causes water damage to your ceiling, you may not be fully covered if the water entered because of a poorly maintained roof.

There are some general and additional exclusions that apply to certain insured events. For full details of what may be excluded, please refer to the relevant page in the Product Disclosure Statement.

Refer to the Product Disclosure Statement (PDS) (PDF 1MB)Refer to the Product Disclosure Statement (PDS) (PDF 1MB)

Exclusions may include:

Things you should know

There are some general and additional exclusions that apply specifically to certain insured events. For full details, please refer to the Product Disclosure Statement.

*A 72-hour exclusion period applies to some insured events. Allianz does not provide cover (where the type of cover you have under the policy provides it) for any loss of or damage to property caused by cyclone, flood, grassfires and bushfires, during the first 72 hours after you first take out or increase the cover under the policy. There are some general exclusions and additional exclusions that apply specifically to certain insured events. Make sure you check these carefully by reading the Product Disclosure Statement.

This information is general in nature and has been prepared without taking your objectives, needs and overall financial situation into account. The information is not advice, recommendation or opinion on any products or services provided by Westpac or third parties. For this reason, you should consider the appropriateness for the information to your own circumstances and, if necessary, seek appropriate professional advice. For more information on any specific products or services distributed or provided by Westpac, you may wish to read the relevant Product Disclosure Statement. To see some of the events covered and not covered, please refer to our Key Fact Sheets (KFS).

Landlord Insurance is issued by Allianz Australia Insurance Limited ABN 15 000 122 850 AFSL 234708 (Allianz). Westpac Banking Corporation ABN 33 007 457 141 AFSL 233714 (the Bank) arranges the initial issue of the insurance under a distribution agreement with Allianz, but does not guarantee the insurance. This information does not take into account your personal circumstances. Before making a decision, please consider the relevant Product Disclosure Statement. For more information call 1300 650 255.

If you take out Landlord Insurance with Allianz the Bank will receive a commission of up to 12% of the premium, excluding Government fees and charges, plus GST.

A target market determination has been made for this product. Please visit www.westpac.com.au/tmd for the target market determination.

By selecting 'Get a quote' you will enter a third-party site hosted by Allianz. Any personal information you provide to Allianz’s hosted site will be collected, used and disclosed in accordance with Allianz’s Privacy Statement and Privacy Policy.

Westpac's Privacy Statement is available at westpac.com.au/privacy/privacy-statement or by calling 132 032 8am – 8pm Sydney time, 7 days. It covers:

- How you can access the personal information Westpac holds about you and ask for it to be corrected;

- How you can complain about a breach of the Privacy Act 1988 (Cth) or a registered Code by Westpac and how Westpac will deal with your complaint; and

- How Westpac collect, hold, use and disclose your personal information in more detail.