Stay on top with our Westpac App Budget Tools

Be the master of your money

- Follow your ins and outs

- Track spending month to month

- Set your own categories

- Spot savings possibilities

Track your ins and outs

Keep your monthly expenses in check with the Westpac App. Get a big-picture view on your home screen using our simple-to-use budgeting tools:

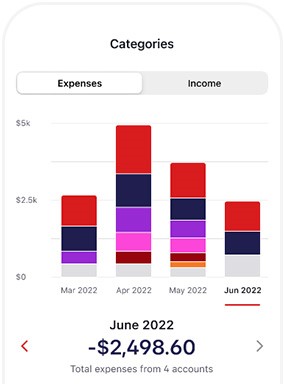

Compare spending across categories

Better understand your spending on essentials and those little luxuries to see where you’ve got money to splash out or where to cut back to save:

- Over 30 category types, ranked by spending

- Re-categorise your transactions or create your own categories

- Tag transactions with unique labels, which you can then filter by

- Get the big picture with monthly/yearly spending overviews

Track trends in your cash flow

Surprised by your bank balance? Tracking your income vs expenses can help you plan for costlier months or those with extra cash ripe for saving:

- Cash flow updates show how you’re tracking each month

- See instantly if you’re ahead or if you need to curb spending

- 12-month interactive summary highlights trends by month

- See which subcategories/categories have the highest percentage spend

Get better visibility in just a few taps

See exactly where you're at, what you're spending and how you could potentially tighten the belt to save. Here's how to get started:

In the Westpac App

- Sign into the Westpac App

- On your home screen tap Insights to view Cash flow and Categories

Don’t get caught short

Use our Budget Planner tool in the App to see how much available cash you’ve got. Simply set your ins and outs and you’ll be able to see what you’ve got left to spend. You can even choose categories and set limits for them to help you track and manage where your money goes.

Frequently asked questions

You can change a transaction subcategory by:

- Tap on the transaction.

- Scroll down to the Subcategory header, tap Edit.

- Select a new subcategory from the list.

To create a custom subcategory:

- Tap on your transaction.

- Scroll down to the Subcategory header, tap Edit.

- Tap Create a subcategory at the bottom.

- Enter the Custom name you'd like, and then tap Save.

- Confirm if you'd like similar transactions to be recategorised. The system will continue to learn as you update your subcategories.

Transactions with a pending category can't be updated and won't appear in your Cash flow and Categories until they're fully processed.

Things you should know

Read the Westpac Online Banking Terms and Conditions (PDF 620KB) at westpac.com.au before making a decision and consider whether the product is right for you.

Westpac’s Online Banking Security Guarantee - If your Westpac account is compromised due to Online fraud, we guarantee to repay any missing funds, provided you complied with our Online Banking Terms and Conditions. This includes keeping your sign-in details (including passwords, Westpac Protect™ Security codes) private, not participating in the unauthorised transaction, and immediately notifying us when you suspect an unauthorised transaction or potential fraud on your accounts.

Westpac Fraud Money Back Guarantee - Our Westpac Fraud Money Back Guarantee ensures that you will be reimbursed for any unauthorised card transactions provided that you have not contributed to the loss and contacted Westpac promptly. Refer to your card’s conditions of use for full details, including when you will be liable.

The Digital Card is only available in the Westpac App and supported with the latest version of the Westpac App. The terms and conditions applicable to your product also apply to the use of your digital card. Online Banking Terms & Conditions also apply. You may not always be able to access your digital card.

Apple, the Apple logo, iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Android, Google Play and the Google Play logo are trademarks of Google LLC.